Meta: AI pushed advertising to soar, Q1′ s revenue broke the record, and Xiaozha scared 1.6 trillion yuan in one sentence.

It can be said that Alphabet (Google’s parent company), Meta and Microsoft, the three giants of American AI, have handed over their own stage test scores, but unlike the impression formed by the outside world in the previous paragraph, Google, which has been constantly sung, has seen its share price soar after the financial report, while Meta, which won a heart by Llama 3, has evaporated by 1.6 trillion overnight.

Only Microsoft continued to exceed expectations, watching the other two unreliable rivals smile and get back the top spot in the world market value.

Google, the big brother who is often upstaged by his peers on various occasions, is finally proud this time.

Not only did Q1′ s revenue, advertising and cloud business all increase at a faster speed, but it also crushed all the indicators, with an increase of over 15% after the close, and announced the dividend distribution and $70 billion stock repurchase plan for the first time.After the financial report was published, Google’s market value soared by 300 billion US dollars, making it the fourth largest listed company in the world after Microsoft, Apple and NVIDIA.

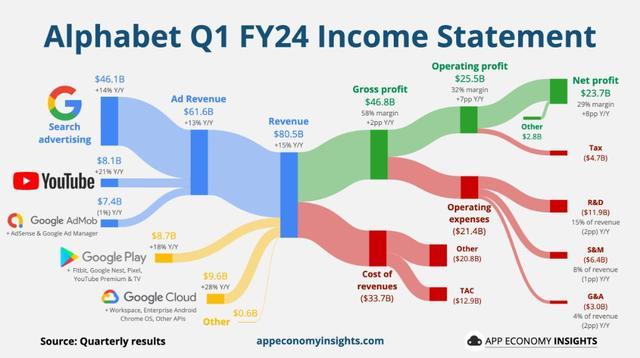

In this quarter, the total revenue of Google’s parent company Alphabet was 80.54 billion US dollars, much higher than the market expectation of 79.04 billion US dollars, up 15% year-on-year, the fastest growth rate in two years. Net profit jumped 57% year-on-year to $23.7 billion, and diluted earnings per share was $1.89, up 61.5% from $1.17 in the same period last year.

Despite betting on the big language model Gemini training and infrastructure investment, the AI capital expenditure of $12 billion this season exceeded expectations by $1.7 billion. Closely related to AI, the growth of cloud business, which is regarded as Google’s next growth engine, is still accelerating rapidly. Revenue in the first quarter increased by 28.4% year-on-year to $9.6 billion, which was higher than the analyst’s expectation of $9.37 billion, and doubled the overall revenue growth rate for several consecutive quarters. Although it ranks third in the market share of cloud computing, it is still trying to catch up with Amazon and Microsoft, but it is finally on the right track of turning losses into wins.

"In the past eight months, we have released more than 1,000 new products and functions in the field of cloud computing. At the Google Cloud Next conference, more than 300 customers and partners talked about their success in artificial intelligence on Google Cloud, including global brands such as Bayer, Mercedes-Benz and Wal-Mart. " Google CEO Sandel Pichai said at the earnings conference.

And the credit still has to be given to AI. Like Microsoft, more and more enterprises seek to deploy AI load on public cloud, and Google Cloud also provides customers with various generative artificial intelligence services through the Gemini model. Recently, a new CPU「Axion "based on Arm architecture was launched, aiming at improving the efficiency of cloud computing and reducing operating costs, and further strengthening Google’s competitiveness in the cloud market. Polat, CFO, stressed that "artificial intelligence is making an increasing contribution" to the sales of Google’s cloud division.

Pichai also believes that the transformation of artificial intelligence is a "golden opportunity", and the company is racing against time to integrate this technology into the whole business.At the Google Cloud Conference earlier this month, everything revolved around generative AI, further opened and optimized Gemini 1.5 Pro, and officially launched its own most powerful and expandable AI accelerator TPU v5p P.

In addition, the core advertising industry has also achieved steady improvement this quarter. Total revenue was $61.6 billion, a year-on-year increase of 13%. Among them, Google search and other advertising revenue was 46.2 billion US dollars, and YouTube advertising revenue was 8.1 billion US dollars, both of which achieved double-digit growth.

However, for Google, which is still positioned as a "search giant" in the market, the boost of generative AI may be a double-edged sword: on the one hand, Google is exploring new income channels such as advertising placement, independent subscription service and enterprise authorization through AI tools such as Gemini to adapt to market changes and needs. On the other hand, improving the generative search experience may affect the original advertising profitability. At the same time, the rookie of AI search engine represented by Perplexity also faces potential challenges.

In fact, compared with Microsoft and Meta, Google has not had an easy time these months. First, Gemini’s image generation function was forced to withdraw from the market because of racial discrimination, which once triggered a controversy about whether Pichai was qualified as CEO of Google. After paying a large amount of severance pay for layoffs, this week, 50 employees protesting against the company’s signing of a cloud computing contract with Israel were fired, causing internal riots.

In the midst of disputes and challenges, this beautiful financial report comes at the right time. Not only has it greatly boosted market confidence, but it also shows that Google has found the right direction in the AI ? ? era. With the recent reorganization of the artificial intelligence department and more attention to product speed, Google’s performance in the second half of the year is still expected.

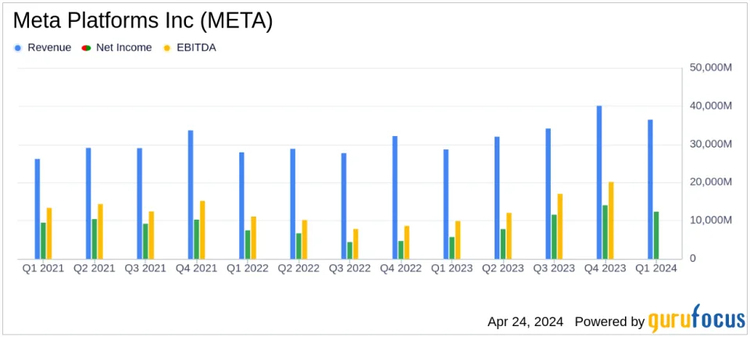

After experiencing the "efficiency year" of business focus adjustment, department reorganization, artificial intelligence and layoffs and cost reduction, Meta made a beautiful turnaround with a revenue of 40.1 billion US dollars in the last quarter. The share price has soared by 140% in the past 12 months, far exceeding Google’s 50% and Microsoft’s 35%.

In this 2024 Q1, the social media giant, which just released a new generation of open source model Llama3, continued to reap the most brilliant first-quarter performance in history, with revenue and profit higher than Wall Street’s expectations.

The data shows that Meta’s total revenue in the quarter was US$ 36.46 billion, a year-on-year increase of 27%, the fastest growth rate in three years. Net profit increased by 117% year-on-year to US$ 12.37 billion, and diluted earnings per share was US$ 4.71, more than double that of US$ 2.2 in the same period last year.

Among them, advertising business is still the core income source of Meta, and the results are gratifying. It increased by 27% year-on-year to $35.64 billion, accounting for nearly 98% of the total revenue. The daily users of FoA increased by 7% year-on-year to 3.24 billion, and the advertising exposure also increased by 20%.

This is mainly due to the application of artificial intelligence technology, which significantly improves the accuracy of targeted advertising. According to Meta, at present, more than half of their advertising recommendations are driven by AI.

After falling to the bottom in 2022, Meta tried to regain the market share of digital advertising. Zuckerberg then launched an initiative to reorganize the advertising business, with the focus on using AI. Susan Li, CFO, once said that the company has been investing in AI models that can accurately predict user-related advertisements and tools that automate the advertising creation process.

In terms of software, Meta recently presented the "GPT-4 level" open source AI model king Llama 3, defeated Gemini 1.5 and Claude 3 in a number of benchmark tests, and upgraded the potential training parameters to 400B b. Widely used in different platforms and scenarios, and vowed to wash off LLM companies and API suppliers with free commercial blood. At the same time, Meta AI is integrated into family applications such as Facebook, Instagram, WhatsApp and Ray-Ban smart glasses to provide users with more flexible and diverse assistant functions.

In terms of hardware, like every colleague who doesn’t want to be stuck, Meta not only stepped up the storage of NVIDIA chips, but also released the latest version of Training and Inference Accelerator (MTIA). Using TSMC’s 5nm process, focusing on strengthening AI reasoning, it is specially designed for the ranking and recommendation system of its social software, and its performance is three times higher than that of the previous generation. They also developed a large rack-mounted system that can accommodate up to 72 accelerators to support self-developed chips. Now they have been deployed in the data center of Meta to complement the commercial GPU.

With the cooperation of AI software and hardware, overseas retailers from China, such as Temu and Shein, also added a fire to Meta’s performance with huge investment in Facebook and Instagram advertisements. And with the approaching of the US presidential election in 2024, political advertising has surged. According to the latest forecast of AdImpact, this year will be the most expensive election cycle in American history, and the advertising expenditure is expected to reach 10.2 billion dollars.

At the same time, due to the annual efficiency adjustment plan, Meta laid off nearly 10% of its employees, and the total number of employees was 69,329 as of March 31, 2024.

In stark contrast to streamlined operations, Xiaozha’s more drastic artificial intelligence layout. In the face of the growing AI war in Silicon Valley, Meta raised its capital expenditure from the expected $30 billion to $37 billion to $35 billion to $40 billion in 2024 to "accelerate infrastructure construction to support the company’s AI roadmap" and continue to compete for top AI talents with high salaries to join the company’s technology research and development.

In addition, he seems to have a "obsession" with the meta-universe, saying that he will continue to invest in long-term goals and "build a virtual world full of incarnations." It should be noted that although the revenue of Reality Labs, which is responsible for VR/AR/MR and Metauniverse development, increased year-on-year, it still lost $3.8 billion, and the total loss has exceeded $45 billion since the end of 2020.

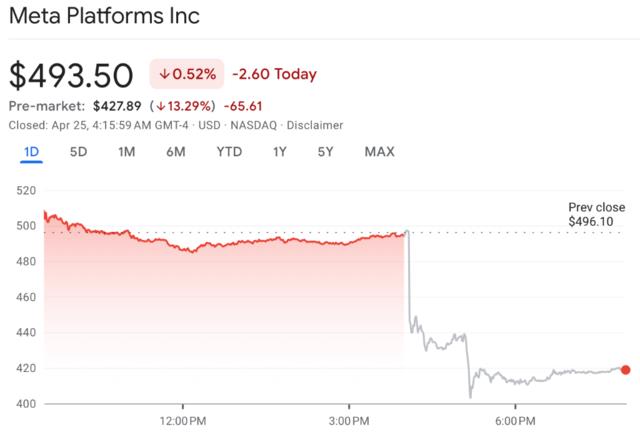

Various unstable factors, together with expanding AI expenditure and a lower-than-expected revenue outlook for the second quarter, have caused the market to worry about Meta’s future sustainable profitability. Despite handing over a super-bright performance answer sheet, Meta’s share price still fell.

And this does not seem to shake Zuckerberg’s determination to push AI. Just as the stock price is diving, the financial report phone will be opened as scheduled.

He firmly told investors that he would spare no expense to build Meta into "the world’s leading artificial intelligence company". It also revealed that Meta is actively exploring a variety of AI revenue-generating strategies, including providing enterprise-level services, introducing advertisements into AI interactions, and allowing people to pay for larger AI models and more access to computing resources. AI has also helped Meta to increase application participation, thus allowing more advertisements to be seen and directly improving advertisements to bring more value.

However, Xiaozha also bluntly said, "Building a leading AI will be a more arduous task than optimizing the application experience, and it may take several years."The implication is that although the long-term value of taking AI is full, don’t expect it to make big money immediately. The words directly scared the market to collapse. Meta’s share price plummeted by 18% after hours, and its market value shrank by nearly $200 billion.

This unexpected trend just reflects the current general attitude of Wall Street towards artificial intelligence: compared with a lot of AI investment, the market wants to see the balance between expenditure and growth, and looks forward to a clearer monetization signal.

However, for Meta, fully embracing AI technology and then applying it to social networks, advertising, metauniverse, wearable devices and other fields, even if it takes several years to turn into considerable profits, it is also determined to pay and wait. Zuckerberg blocked his future this time, and he won’t go back when he opens his bow.

Unlike Meta, which was plunged by the Nasdaq market, Microsoft gained momentum after its financial report was released. It rose by 5% after hours, and overtook Apple for the nth time to become the highest value company in the world.

As the first commercial track leader to bet on generative artificial intelligence, Microsoft’s performance is still firm, and all business indicators have exceeded expectations:

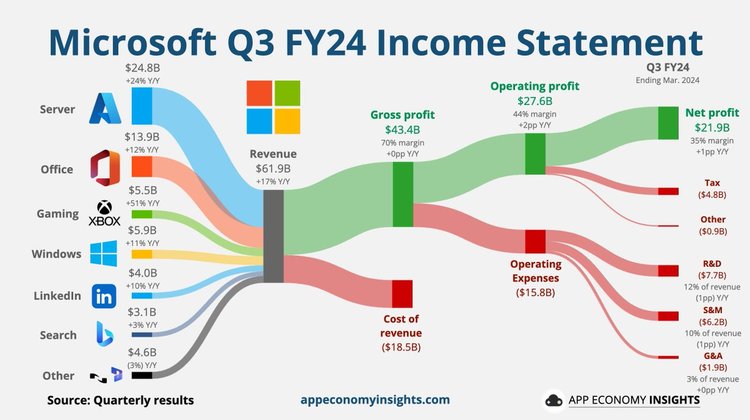

The total revenue was $61.86 billion, up 17% year-on-year, exceeding the previous official guideline of 14.5%. The net profit was $21.94 billion, up 20% from $18.3 billion in the same period last year. The adjusted earnings per share was $2.94, higher than the market expectation of $2.82.

Driven by the strong demand of AI, Intelligent Cloud, including Azure public cloud, Windows server, voice recognition software Nuance and GitHub, continued to live up to expectations, with revenue increasing by 21% year-on-year to $26.7 billion, higher than the market expectation of $26.25 billion. The growth rate was the highest in five fiscal quarters, and it also surpassed rivals Amazon AWS and Alphabet Google Cloud.

Among them, Azure and other cloud services increased by 31% year-on-year, and 7 percentage points came from AI contribution.

In this regard, CEO Nadella pointed out in a conference call that "Azure has become the center of AI projects, involving not only AI models, but also databases and other services. Many customers are using Microsoft platforms and tools to build their own AI solutions:

More than 65% of Fortune 500 companies are using Azure OpenAI service, and GitHub Copilot for developers has 1.8 million paid subscribers. 30,000 customers use Copilot Studio low-code tools to customize their own Copilot. "

In addition to intelligent cloud, since this is the first full quarter since Microsoft launched 365 Copilot generative artificial intelligence assistant to commercial customers last November, the market is also very concerned about the sales performance of Office suite.

Nadella said that Copilot has embedded the latest technology of OpenAI into Microsoft’s entire product line to provide customers with various value-added services. The data shows that the revenue of productivity and business process departments increased by 12% year-on-year to $19.6 billion in this quarter, of which the revenue of Office 365 increased by 15%, and the number of paid subscribers has reached 80.8 million. It is expected that it will continue to achieve steady growth in the next fiscal quarter-which shows that Microsoft has a solid foundation and remarkable achievements in the commercialization of AI software.

In addition, thanks to the acquisition of Activision Blizzard in October last year, Microsoft’s personal computing revenue, including game business, also achieved double-digit growth to $15.6 billion, and Xbox performance increased by 62% year-on-year.

Nadella confidently said: "Microsoft is leading a new era of AI transformation, bringing better business results to various roles and industries."

Since the beginning of this year, Microsoft has been making great moves in the field of AI. On the eve of the financial report, an exciting news was announced: on the basis of the 2020 cooperation agreement with Coca-Cola Company, we will continue to sign a five-year strategic contract worth $1.1 billion. Help it achieve further digital transformation through Microsoft Azure Cloud, Microsoft 365 Copilot tools and leading generative artificial intelligence technology.

Last week, Microsoft’s artificial intelligence empire expanded to the Middle East for the first time: it invested $1.5 billion in G42, an AI company in the United Arab Emirates, and obtained its minority stake and board seats. Meanwhile, G42 will run its AI applications and services on the Azure cloud computing platform.

In the layout of the big model, after spending $13 billion on OpenAI, Microsoft also decided not to spoil ChatGPT alone, but to open up more possibilities. In February, it was announced that it had reached an in-depth cooperation with Mistral AI, a French star AI startup, investing 150,000 euros and providing computing infrastructure to assist in large-scale model training and reasoning. Mistral has also become the second commercial closed-source model supplier of Microsoft besides OpenAI.

In March, after leading the latest round of financing for the artificial intelligence unicorn Infection AI, Microsoft directly poached its two co-founders and most of its technical staff. Mustafa Suleyman, the former CEO of Influence, was appointed as the CEO of Microsoft AI, a newly established artificial intelligence department, responsible for integrating consumer toC products, including Copilot, Bing and Edge, and reporting directly to Nadella. Another co-founder Karen Simonyan joined as the chief scientist. One operation not only obtained the authorization of Influence technology, but also completed the talent acquisition of "hollowing out" level, which once shocked the industry.

In terms of hardware, in addition to introducing two new Surface as the next generation AIPC, Microsoft is also developing a new network card similar to NVIDIA ConnectX-7 to support the self-developed Maia 100. It also plans to hoard 1.8 million AI chips by the end of this year and triple the number of GPUs. Significant progress has also been made in building a data center worth up to $100 billion with OpenAI and building a supercomputer called "Stargate".

Bet on a number of mainstream large model development teams, make great strides in data processing capabilities, coupled with the stronger technical advantages after the launch of GPT-5, Microsoft has a stable position in the Jianghu.

Looking at the new round of financial performance of Meta, Alphabet and Microsoft, it is not difficult to see that generative artificial intelligence has penetrated into all aspects of the business pipeline and become the core engine driving enterprise growth.

Microsoft’s success is particularly typical, with a number of AI software and hardware forward-looking layout firmly in the top spot, and various businesses take off at high speed.

Although Meta’s huge AI investment makes investors jumpy, it is still unknown whether it can realize commercial profit as soon as possible, but the advertising revenue boosted by AI has achieved initial results. With Llama’s big model and computing power blessing, Zuckerberg’s determination and ambition to build a global AI leader should not be underestimated.

As for big brother Google, it finally found its own rhythm in the AI ? ? war. Weapons such as Gemini and TPU have sharpened their swords and are ready to accelerate the search for new growth points in the AI wave.

The judgment of the three giants on the development direction of artificial intelligence is surprisingly consistent, and they all offered a gamble of real money to invest in this future technological change. Standing on the cusp of the times, how high and how far AI can finally take them, the eyes of the global technology industry will look here.

(The cover picture is from Josh Edelson/AFP via Getty Images)