The World Federation of Taiwan issued the heaviest ticket, and China snooker suffered a "dark moment"

Reporter |

Edit | Louchanqin

Recently, L ‘Oreal, Estee Lauder, Shiseido, Amore Pacific and other beauty industry giants have released financial reports, from which we can get a glimpse of the future changes in the beauty market.

China market, with its vast territory and rapid development, was once a bright spot in the financial reports of international beauty giants, and even became the second center of the whole group outside the local market. However, in the past year, due to the epidemic, offline retail performance was not satisfactory, consumer confidence decreased, and the overall performance of the beauty market in China was not good.

According to the data released by the National Bureau of Statistics, in 2022, the total domestic retail sales of cosmetics was 393.6 billion yuan, down 4.5% year-on-year. This is also the first time that the total retail sales of cosmetics has experienced negative growth in the past 10 years.

This trend is also directly reflected in the financial report of the beauty group which regards China as its core market.

In the six months to December 31, 2022, Estee Lauder’s total revenue dropped by 14% year-on-year, and its net profit halved. The financial report pointed out that it was mainly due to the obvious impact of the epidemic on the Asia-Pacific tourism retail, especially the mainland market in China.

Coincidentally, in 2022, the net profit of Amore Pacific Construction Group, which is still not out of the shadow of the epidemic, nearly halved, down 48.9% year-on-year, and its revenue also dropped by 15.6%. Under the strong performance of double-digit growth in North America and Europe, 60% of the sales in the Asia-Pacific region came from the China market, and the revenue in the China market, which became a burden, fell by 30%.

Although Shiseido Group maintained net sales and core operating profit growth of 5.7% and 20.6% respectively in 2022, its net profit returned to its mother declined by 27.1%. Among them, the revenue of the two pillar markets in Japan and China decreased by 8.2% and 6% year-on-year. However, China market continues to be the largest market of the Group with a share of 24.2% of the Group’s total revenue.

Under a downward trend, only the L ‘Oré al Group has outstanding performance.

L ‘Oré al Group released its 2022 financial report, which showed that its revenue increased by 18.5% year-on-year, and still increased by 23.4% compared with 2019, and its net profit increased by 24.1%. Among them, North Asia’s revenue increased by 14.8% year-on-year, and China’s online sales increased by double digits despite the epidemic. Especially in the field of high-end beauty, the market share of L ‘Oré al China exceeds 30%.

Although the overall performance of the China market was poor last year, the above-mentioned beauty groups are still optimistic about the future possibilities after the China market recovers, and actively invest more in new development directions.

Shiseido Group predicts that the annual sales in China market will increase by 8% in 2023. At the same time, Shiseido Group stated in its latest medium-term strategy "SHIFT 2025 and Beyond" that it will expand its brand portfolio and develop new fields in China.

In fact, Shiseido has been laid out from these two aspects since last year. In August, 2022, after completing the relevant regulatory filing, Ziyue Fund, which was exclusively funded by Shiseido China, invested nearly 100 million yuan for the first time to lead the investment in Jiangsu Chuangjian Medical Technology Co., Ltd., a collagen biomaterial enterprise. In the same year, INRYU, the law of oral beauty brand flow, and SIDEKICK, a men’s skin care brand, officially entered the China market.

In addition to the main business of skin care products and cosmetics, Amore Pacific is also interested in introducing new brands to find new growth points. In December, 2022, Amore Pacific Construction Group said that she would revive GoutalParis, a French perfume brand acquired eleven years ago, and planned to introduce it into the China market.

Perfume fragrance is undoubtedly a hot track in China beauty market in recent two years. The rise of local brands such as Watching Summer and Wenxian DOCUMENTS, as well as the opening of overseas high-end perfumes such as L’Artisan and Penhaligon’s by Artisan prove that there is still considerable room for growth in this segment.

It is worth mentioning that last year, L ‘Oré al also targeted the development of local fragrance field in China. In September 2022, Shanghai Meicifang Investment Co., Ltd., a subsidiary of L ‘Oré al China, announced a minority investment in Wenxian DOCUMENTS. This is also the first venture capital investment of the American side in China since its establishment in early May 2022.

Like Shiseido’s strategy, in addition to local investment, L ‘Oré al Group also introduced a new French luxury cinema brand Carita CARIDAE in August 2022. At present, the brand has opened one boutique in Beijing, Shanghai, Shenzhen and Nanjing.

L ‘Oré al is also deepening the construction of local upstream supply chain. In October of the same year, L ‘Oré al expanded Suzhou Shangmei factory, its clean workshop was officially opened, and the intelligent operation center also broke ground.

In August, 2022, Estee Lauder introduced the hair care brand Aveda to China, and also strengthened the construction of local teams from the upstream supply chain and domestic tax-free channels.

In December 2022, Estee Lauder China Innovation R&D Center was opened in Shanghai. As early as 2005, Estee Lauder R&D Center was established in Shanghai, and was upgraded to Asia-Pacific R&D Center of the Group in 2011. The upgraded China Innovation R&D Center will become an integral part of the group’s R&D network covering Asia, North America and Europe.

Recently, Estee Lauder also announced the establishment of Estee Lauder Tourism and Retail Services (Hainan) Co., Ltd., and the headquarters of the group’s tourism and retail in China will be located in Hainan Free Trade Port. This may help Estee Lauder coordinate and control the huge price difference between tax-free channels and tax-paid channels. For example, according to Xiaohongshu netizens, Estee Lauder in Hainan recently launched a 40% discount on small brown bottles. In the case that the regular price of 100ml small brown bottles in Tmall flagship store is 1870 yuan, two bottles in Hainan duty-free channel only need 756 yuan.

For these beauty groups that have been rooted in China for a long time, the challenge of the China beauty market after a cold rejuvenation is still not small. In order to make up for the lost profits, price increase has become the most direct strategy for many brands to increase their income in the short term. Many international beauty brands, such as Estee Lauder, Lancome, Chanel, Dior and Guerlain, have raised the prices of their products since February 1st.

To sum up, it is the common strategy of international beauty group in China at this stage that high-end brands continue to pay a premium to improve their profit margins, new brands explore growth opportunities in sub-sectors and build local supply chains.

Text |C2CC New Media

As the year approaches, I believe we are most concerned about two things: First, the A shares that have repeatedly fallen below 2,800 points have made China investors "lose their shorts"; second, whether the annual meeting and the year-end bonus will be "a fart year" as Wang Jianlin said, or "don’t give up hope even if you lose everything in the secondary market, after all, there is still a tertiary market".

The good news is that according to the data released by the national statistics department, the gross domestic product (GDP) of China reached 126.06 trillion yuan in 2023, up 5.2% year-on-year, and the growth rate was 2.2 percentage points faster than that of 2022.

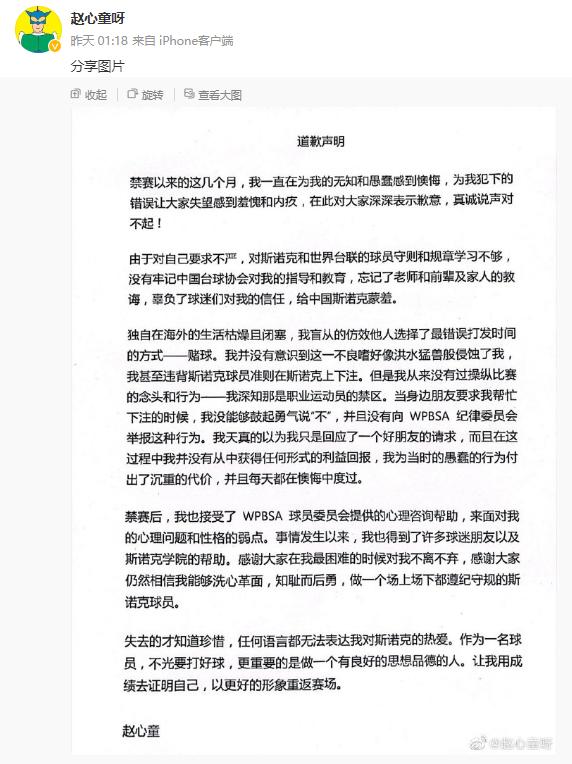

In addition, the National Bureau of Statistics released the domestic consumption data for the whole year of 2023. From January to December 2023, the total retail sales of social consumer goods was 47,149.5 billion yuan, an increase of 7.2% over the previous year. Among them, the retail sales of cosmetics was 414.2 billion yuan, up 5.1%, and the growth rate of cosmetics market did not outperform the market.

At the end of January, 2024, listed beauty companies at home and abroad released their 2023 financial reports and performance forecasts one after another. C2CC Media’s "Counting Beauty" column counted the relevant financial report data, and found that for domestic beauty companies, profit growth and turning losses into profits are the main melody melody, but it seems that profit growth can’t save the bleak capital market, while international beauty companies are mixed. Behind the performance growth, it is more through "price increase strategy" to offset the continuation of product sales.

We can also spy from the import and export data released by the General Administration of Customs in 2023. From January to December 2023, the total import and export value was 41.76 trillion yuan, up 0.2% year-on-year, of which the quantity and amount of cosmetics showed a double downward trend. From January to December, the import of beauty cosmetics and toiletries was 358,600 tons, down 14.2% year-on-year, and the total import value was 126.02 billion yuan, down 15.2% year-on-year.

1. Marubi shares: the net profit increased by 72-89% in advance, and the performance reached a new high.

On January 22nd, Guangdong Marubi Biotechnology Co., Ltd. (hereinafter referred to as Marubi) released the annual performance forecast for 2023.

The performance forecast shows that, according to the preliminary calculation by the financial department of the company, the net profit in 2023 is expected to be RMB 300 million to RMB 330 million (hereinafter all RMB), which will increase by RMB 126 million to RMB 156 million compared with the same period of last year, with an increase of 72% to 89%. It is estimated that in 2023, Marubi’s net profit after deducting non-recurring gains and losses attributable to the owners of the parent company will be 220 million yuan to 250 million yuan, which will increase by 84.05 million yuan to 114 million yuan compared with the same period of last year, with a year-on-year increase of 62% to 84%.

As for the growth of performance, Marubi said in the preview that the main reason was that the company actively promoted the transformation of online channels and better grasped the annual marketing rhythm. Among them, Marubi brand’s content e-commerce represented by Tik Tok Aauto Quicker increased by over 100%, and the second brand PL’s love for fire increased by over 100%.

2. Freda: The annual revenue exceeded 2 billion.

On January 23rd, Lushang Freda Pharmaceutical Co., Ltd. (hereinafter referred to as "Freda") released the annual performance forecast for 2023.

According to the performance forecast, according to the preliminary calculation by the financial department, it is estimated that the net profit attributable to shareholders of listed companies in 2023 will be 260 million yuan to 290 million yuan, an increase of 215 million yuan to 245 million yuan compared with the same period of last year, an increase of 472% to 538%.

It is estimated that the net profit of listed public shares after deducting extraordinary gains and losses will be 116 million yuan to 146 million yuan in 2023, which will increase by 58 million yuan to 88 million yuan compared with the same period of last year, with a year-on-year increase of 98% to 150%.

For the surge in net profit, Freda said that the core reason benefited from the divestiture of real estate development business, and at the same time, relying on solid scientific and technological research and development strength and the advantages of multi-brand omni-channel development, it constantly empowered the development of core business, especially the performance of cosmetics.

3. Shuiyang shares: the net profit doubled.

On January 18th, Shuiyang Company released its 2023 annual performance forecast.

The annual performance forecast shows that in 2023, Shuiyang Co., Ltd. is expected to achieve a net profit of 280 million yuan to 320 million yuan, a year-on-year increase of 124%-156%, and a non-net profit of 260 million yuan to 300 million yuan, an increase of 169%-210%.

For the reasons of high performance growth, Shuiyang believes that the overall business and product structure are further optimized, the brand matrix is perfect, and the proportion of high-margin brands continues to rise. At the same time, the company insists on refined operation, continuously improves management efficiency, continuously improves organizational system construction, and improves the effect of cost control.

4. Beauty and Beauty Makeup: Net profit turned into profit.

On January 30th, Liren Lizhuang disclosed the 2023 annual performance forecast.

The forecast shows that Liren Lizhuang expects to achieve a net profit of 28 million yuan to 35 million yuan in 2023, especially in the fourth quarter. The company turned losses into profits throughout the year and its business operations continued to improve.

Liren Lizhuang pointed out in the announcement that the company’s net profit attributable to shareholders of listed companies in 2023 turned into profit compared with that in 2022, mainly due to the growth of the company’s emerging channel business, the smooth progress of incubating brands, the improvement of inventory structure and the overall cost control.

5. Runben shares: The revenue scale continues to grow.

On January 24th, Runben shares released the 2023 annual performance forecast.

The forecast shows that Runben shares are expected to realize a net profit of 215 million to 235 million yuan in 2023, an increase of 34.34% to 46.83%; Non-net profit deduction is estimated to be 207 million to 227 million yuan, up 34.1% to 47.05% year-on-year. In Q4 alone, the company expects to realize a net profit of RMB 34-54 million, up by 17-86% year-on-year, and realize a net profit of RMB 30-50 million deducted from non-homecoming.

The report pointed out that the pre-increase in performance was mainly due to the company’s further expansion of baby care products and product matrix, and the proportion of baby care products further increased, which improved the overall profitability of the company. At the same time, the company continuously strengthened operation management and continuously improved operation management efficiency, and the sales expense ratio decreased year-on-year.

6. Ruo Yuchen: The net profit is expected to increase by nearly 62%

On January 29th, Ruo Yuchen released the 2023 annual performance forecast.

According to the report, it is estimated that the net profit attributable to shareholders of listed companies during the reporting period will be RMB 42 million to RMB 54.6 million, an increase of 24.42% to 61.75% over the same period of last year; Non-net profit was 41 million yuan to 53.6 million yuan, an increase of 29.01% to 68.65% over the same period of last year.

Ruo Yuchen said that the increase in operating performance in 2023 stems from the company’s strengthening of refined operations in 2023, reducing operating costs from multiple dimensions, strengthening control over expenses and budgets, improving overall operating efficiency, and improving the company’s costs and various expenses as a whole; In addition, in 2023, the operating income of its own brand "Zhanjia" increased significantly. During the reporting period, the introduction of new brands such as "Ai Weinuo", "Ai Ziran" and "Kang Wang" developed rapidly, which had a positive impact on the company’s operating performance.

7. Celebrity Health: The net profit may exceed 100 million yuan.

On January 29th, Mingchen Health Products Co., Ltd. (hereinafter referred to as "Mingchen Health") released the annual performance forecast for 2023.

The forecast shows that the estimated net profit attributable to shareholders of listed companies in 2023 is between 70 million yuan and 100 million yuan, compared with 25.33 million yuan in the same period last year, up by 176.35% to 294.79%. Non-net profit was between 65 million yuan and 95 million yuan, up 1462.68% year-on-year to 2091.61%.

8. Kesi shares: Net profit soared by nearly 96%

On January 15th, Nanjing Kesi Chemical Co., Ltd. (hereinafter referred to as Kesi) released the 2023 annual performance forecast.

According to the report, it is estimated that the net profit of returning to the mother in 2023 will be 720 million yuan to 760 million yuan, an increase of 85.5% to 95.8%; Deducting the net profit of non-returning to the mother was 703 million yuan to 743 million yuan, with an increase of 85.8% to 96.4%.

For the continuous high growth of performance and net profit in 2023, Kesi shares said in the forecast that due to the steady improvement of the company’s market position and the continuous growth of the market demand for sunscreen products, at the same time, due to the improvement of the company’s overall capacity utilization rate and the rapid release of the production capacity of new products represented by new sunscreen agents, it will eventually help the company’s main business income and gross profit margin level increase. In the future, KES will invest and build the "Malaysia Annual 10,000 Tons Sunscreen Series Product Project" in Malaysia to expand the market demand in Asia Pacific, Europe and other regions.

9. Aimeike: The annual net profit is nearly 2 billion yuan.

On January 5th, Aimeike released the 2023 annual performance forecast.

It is estimated that Aimeike will achieve a net profit of 1.81 billion to 1.9 billion yuan for the whole year, a year-on-year increase of 43% to 50%; Non-net profit was 1.782 billion to 1.872 billion yuan, up 49% to 56% year-on-year.

For the huge increase in net profit, Aimeike said in the preview that the company actively pays attention to market changes, provides high-quality services for downstream medical and beauty institutions at the academic and operational ends, better meets the needs of beauty seekers, and enhances the depth of cooperation with customers. At the same time, through the distribution model, it further expands the number of institutions covered by the company’s products and enhances the breadth of cooperation with customers.

10. Two-faced needle: the performance turned losses, and the net profit increased by over 147%.

On January 30th, "Toothpaste No.1" Double-sided Needle released the performance forecast for 2023.

According to the forecast, it is estimated that the two-sided needle will turn losses from January to December 2023, and the net profit attributable to shareholders of listed companies will be 18 million to 27 million yuan, with a year-on-year increase of 146.65% to 169.97%.

As for the turnaround in performance, the company said that in 2023, by opening up product sales channels and increasing product sales, the company’s profits increased accordingly. Among them, the operating income and net profit of its subsidiary, the hotel supplies business, increased significantly year-on-year.

11. Qingdao Golden King: Turn the net profit into profit.

On January 30th, Qingdao Jinwang Applied Chemistry Co., Ltd. (hereinafter referred to as "Qingdao Jinwang") disclosed the 2023 annual performance forecast.

According to the forecast, it is estimated that the net profit of Qingdao Jinwang returning to his mother in 2023 will be 11 million yuan to 16.5 million yuan, with a loss of 809 million yuan in the same period of last year; Deducting non-net profit is expected to be-4 million yuan to 2 million yuan.

According to the data, Qingdao Jinwang’s main business is divided into three parts: new material candle and aromatherapy and craft products business, cosmetics business and supply chain business. Among them, new materials, candles, aromatherapy and craft products business and cosmetics business are the core business development sectors of the company.

Qingdao Jinwang said in the notice that the main reason for the change in performance was that the company’s cosmetics business gradually recovered in 2023, but some subsidiaries’ cosmetics business failed to meet expectations.

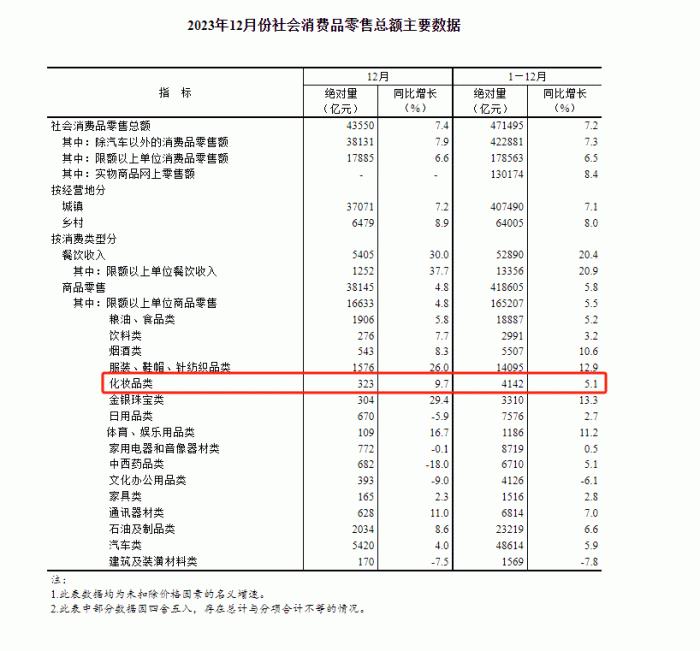

1. LVMH Group: perfume and beauty business increased by 7%.

On January 25th, LVMH Group announced its annual performance report for 2023.

According to the financial report, in the twelve months ended December 31st last year, LVMH Group’s sales revenue increased by 9% year-on-year to 86.2 billion euros (about 670.82 billion yuan), its gross profit rate was 69%, its operating profit increased by 8% to 22.8 billion euros (about 177.39 billion yuan), and its net profit increased by 8% to 15.2 billion euros (about 118.20 billion yuan). Among them, the annual sales of perfume beauty business increased by 7% to 8.27 billion euros (about 64.3 billion yuan), an organic increase of 11%; The selected retail departments where DFS and Sephora are located have benefited from the recovery of global tourism retail and become the best-performing business of LVMH. The annual revenue increased by 20% year-on-year to 17.9 billion euros (about RMB 139.21 billion), with an organic increase of 25%, and the operating profit increased by 76% to 1.4 billion euros (about RMB 10.88 billion).

In terms of regions, Asia is the largest consumer market of LVMH, and Asia including China (excluding Japan) contributed the highest revenue of 26.707 billion euros, accounting for 31% of the Group’s revenue, up 1% from 2022. The United States and Europe contributed 21.538 billion euros respectively, accounting for 25% of the Group’s revenue, of which the proportion of revenue in the United States decreased by 2 percentage points, while that in Europe increased by 1 percentage point; Japan’s revenue was 6.031 billion euros, accounting for 7% and 12% in other regions.

LVMH Group said in the financial report that although there are still uncertainties in the geopolitical and macroeconomic environment, LVMH is full of confidence in its ability to continue to grow in 2024, the highly unique quality and creativity of its products and the professionalism of its management, and believes that it can stand out and gain market share.

2. Procter & Gamble: The annual net sales exceeded 600 billion yuan for the first time.

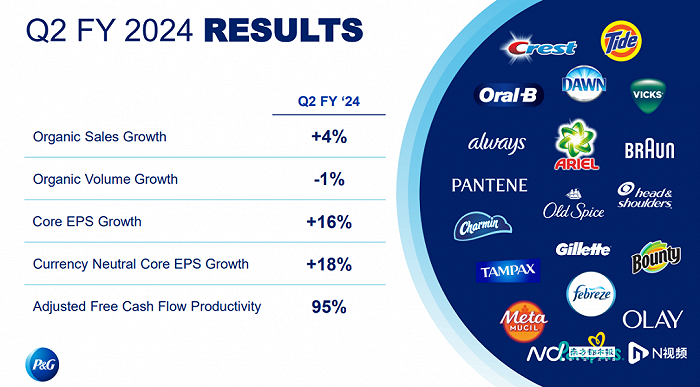

On January 23rd, Procter & Gamble released the second quarter (September 2023-December 2023) and annual performance report of fiscal year 2024.

The report shows that in 2023, P&G achieved a net sales of 83.964 billion US dollars (about 601.1 billion yuan) and a net profit of 14.861 billion US dollars (about 106.4 billion yuan). Among them, the company’s net sales in the second quarter was 21.4 billion US dollars (about 153.2 billion yuan), an increase of 3% over the previous year; The net profit of returning to the mother fell by 11.8% year-on-year to 3.468 billion US dollars (about 24.8 billion yuan).

In terms of departments, the organic sales of Beauty department in the second quarter was US$ 3.849 billion (about RMB 27.590 billion), an increase of 1%. The organic sales of Health Care department was 3.172 billion US dollars (about 22.738 billion yuan), up by 2%. The organic sales of Grooming department for men was US$ 1.734 billion (about RMB 12.430 billion), up by 9%. The organic sales of Baby, Feminine &Family Care department was 5.146 billion US dollars (about RMB 36.888 billion), with an increase of 2%; Fabric &Home Care’s organic sales amounted to US$ 7.415 billion (about RMB 53.152 billion), an increase of 5%.

It is worth mentioning that P&G highlighted in its financial report that its sales in the second largest market, Greater China, dropped by 34% due to the slowdown in demand for high-end skin care brand SK-II and other products, mainly due to the impact of nuclear sewage discharge in Japan.

3. Chiwaton: The perfume business leads the growth.

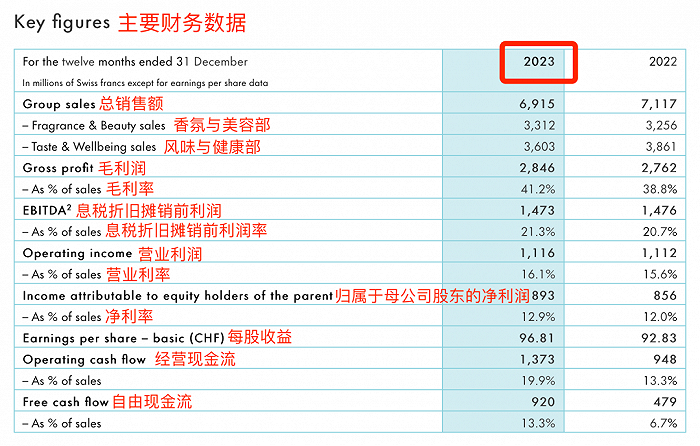

On January 25th, the Swiss flavor and fragrance company Givaudan released its annual financial report for 2023.

According to the financial report, the total sales of Chihuaton in 2023 was 6.915 billion Swiss francs (about 57.481 billion yuan), up 4.1% year-on-year, and down 2.8% year-on-year in terms of Swiss francs. The annual sales of perfume and beauty department in 2023 was 3.312 billion Swiss francs (about RMB 27.531 billion), up by 7.6% year-on-year, and increased by 1.7% year-on-year in terms of Swiss francs.

Among them, the sales of high-end perfume increased by 14.0% year-on-year, the sales of consumer goods increased by 7.1% year-on-year, and the sales of essence components and active beauty business increased by 1% year-on-year.

In terms of regions, sales in Europe and the Middle East reached 2.717 billion Swiss francs (about 22.653 billion yuan) last year, up 8.4% year-on-year, ranking first; In the Asia-Pacific region to which China belongs, sales amounted to 1.698 billion Swiss francs (about 14.157 billion yuan), up 3.9% year-on-year; The total sales in North America reached 1.653 billion Swiss francs (about 13.782 billion yuan), down 6.8% year-on-year; Latin America has the fastest growth rate, achieving sales of 847 million Swiss francs (about 7.062 billion yuan), up 15.1% year-on-year.

Chiwaton said in the performance report that the good growth benefited from the sustained strong performance of high-end perfume business, the continuous high level of new business, the increase in pricing of all businesses and the increase in the growth rate of consumer goods business in the second half of 2023.

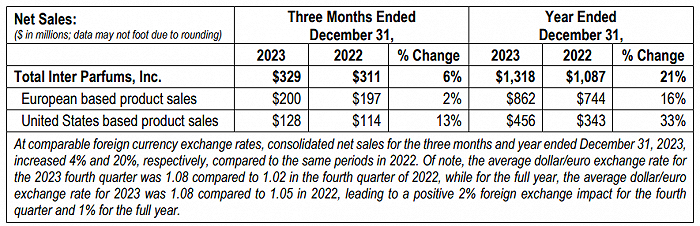

4. Inter Parfums: The annual net sales increased by 21%.

On January 24th, Inter Parfums, a perfume manufacturer, released its financial reports for the fourth quarter and 2023 as of December 31st, 2023.

The financial report shows that the net sales of Inter Parfums in the fourth quarter was 329 million US dollars (about 2.357 billion yuan), up by 6%. In 2023, the company’s overall net sales were 1.32 billion US dollars (about 9.455 billion yuan), an increase of 21%.

By region, the sales of Inter Parfums’ European business increased by 2% to 200 million US dollars (about 1.433 billion yuan) in the fourth quarter; The annual sales of European business reached US$ 862 million (about RMB 6.175 billion), up by 16%. In the fourth quarter, the sales of American business increased by 13% to US$ 128 million (about RMB 917 million), and the annual sales of American business was US$ 456 million (about RMB 3.266 billion), up by 33% year-on-year.

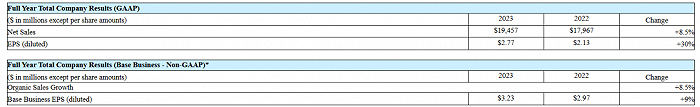

5. Colgate: Toothpaste accounts for 41.1% of the global market.

On January 26th, Colgate announced the financial performance data for the fourth quarter and the whole year of 2023.

The data shows that Colgate achieved net sales of 19.457 billion US dollars (about 139.612 billion yuan) in 2023, an increase of 8.5% year-on-year. In the fourth quarter, Colgate achieved net sales of US$ 4.95 billion (about RMB 35.518 billion), a year-on-year increase of 7%.

Colgate said in the financial report that its net sales and organic sales both increased by 7% in the fourth quarter, and it still maintained a leading position in the toothpaste industry and manual toothbrush field. Among them, the global market share in toothpaste industry accounts for 41.1%, and the global market share of manual toothbrushes accounts for 31.5%.

6. L ‘Occitane: China market contributed 21.9%.

On January 30th, L ‘Occitane Group released its financial report for the third quarter and the first nine months of fiscal year 2024 as of December 31st, 2023.

The financial report shows that L ‘Occitane’s sales in the first nine months reached 1,915.3 million euros (about 14,883 million yuan), an increase of 18.9% according to the reported growth rate and 24.8% according to the fixed growth rate. Net sales in the third quarter reached 843.4 million euros (about 6.554 billion yuan), an increase of 19.5% at the reported rate and 24.6% at the constant rate.

In terms of regional performance, the Asia-Pacific region grew by 6.7% in the nine months of fiscal year 2024, and the China market contributed a strong growth of 21.9%.

Regarding the steady sales momentum in the first nine months, L ‘Occitane said that the growth was mainly due to the continuous excellent performance of Sol de Janeiro, the positive performance of Elemis and the steady growth of L’Occitane en Provence in China.

7. Amore Pacific: Double decline in performance and profit.

On January 30th, Amore Pacific Construction Group released its financial report for the fourth quarter and the whole year of 2023.

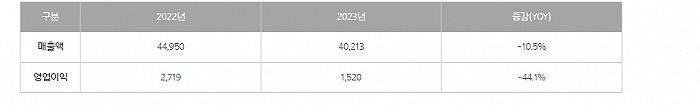

According to the financial report, in 2023, the group’s annual sales were 4,021.3 billion won (about 21.675 billion yuan), down 10.5% year-on-year; Operating profit was 152 billion won (about 819 million yuan), down 44.1% year-on-year. Among them, the sales in the fourth quarter of 2023 was 1,018 billion won (about 5.487 billion yuan), down 14% year-on-year; Operating profit was 29.9 billion won (about 161 million yuan), down 62% year-on-year.

8. LG’s healthy life: weak demand in China has become the key to the decline in performance

On January 31st, LG Life Health released its fourth quarter and full-year financial report for 2023.

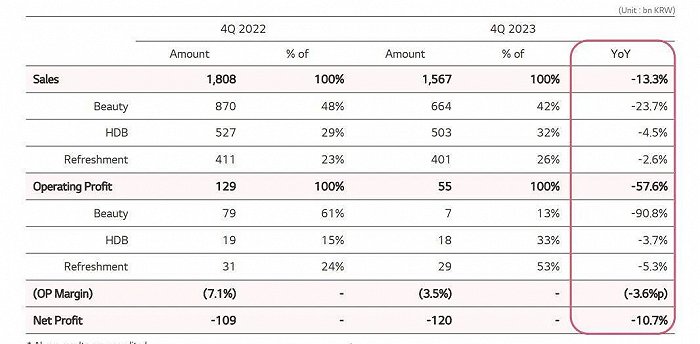

According to the financial report, the annual sales of LG Life Health in 2023 was 6804.8 billion won (about RMB 36.609 billion), down 5.3% year-on-year, and its operating profit was 487 billion won (about RMB 2.616 billion), down 31.5% simultaneously. In Q4 of 2023, LG’s life and health sales amounted to 1,567.2 billion won (about RMB 8.419 billion), down 13.3% year-on-year, and its operating profit was 54.7 billion won (about RMB 294 million), down 57.6% year-on-year.

LG Life Health said in the financial report that the sales of beauty cosmetics, HDB and refreshments all declined in 2023, the profitability of beauty cosmetics declined due to weak demand in China, and the operating profit declined due to overseas restructuring.

The Spring Festival in 2020 is coming, and having a reunion dinner has become the most anticipated moment for many families in a year. Do you prepare your own New Year’s Eve dinner at home or choose to go to a restaurant to enjoy the feast? How to ensure food safety? On January 14th, the reporter followed Hubei Provincial Market Supervision Bureau to Wuchang Dacheng Road Market and Hujin Restaurant for food safety surprise inspection.

Pictured: Market supervision staff are sampling.

In Dacheng Road Market, the staff carefully inspected the meat quality inspection certificate and animal quarantine certificate of each pork stall, and then conducted on-site sampling inspection on all kinds of vegetables in the market to check whether the pesticide residues were qualified. The reporter learned that before 7 o’clock every morning, the market supervision staff in the area will randomly select 10-12 varieties of vegetables in the market for on-site inspection. All the test results will be published on the "vegetable test results publicity" display screen in the market, and the name of the dish, the booth and the test results will be clearly written. And this kind of work will be staged in the major farmers’ markets in Wuhan every day.

Pictured: Dacheng Road Vegetable Test Results Publicity Display Screen

Many families choose to have dinner in the restaurant for the Spring Festival reunion dinner. The reporter followed the market supervision staff to Hujin Restaurant and made a surprise inspection of the implementation of the food safety management system in the restaurant, such as environmental sanitation, equipment and facilities, procurement and storage of raw materials, tableware cleaning and disinfection, and sample retention. According to the inspection results, the hardware facilities of the restaurant are good, the cleanliness of tableware is kept at a good level, and the hygiene management is in place.

Pictured: The staff is carrying out sanitary inspection on tableware.

Hubei Provincial Market Supervision Bureau issued food safety consumption tips for Spring Festival dinners to remind consumers to pay attention to food safety for holiday dinners.

First, we should pay attention to the hygiene of dining places. Consumers are advised to choose a safe and hygienic catering unit to eat, and try to eat in a restaurant with a food business license, good sanitary conditions, complete facilities, high quantitative level (smiling or laughing face) and the implementation of "bright kitchen". The video of the "bright kitchen" catering unit can supervise the post-kitchen processing and production process. Try to avoid going to restaurants that rank and turn over too many tables to eat, and prevent food safety problems in cleaning and disinfection due to super reception.

The second is to pay attention to the safety of dishes and ingredients. Holiday dinners should pay attention to a balanced diet, a combination of meat and vegetables, and reasonable nutrition. The ingredients should be mainly fresh in the season, and more hot foods should be cooked and cooked. High-risk foods such as bright-colored stewed vegetables, cold dishes, raw seafood, green beans and wild mushrooms should be carefully selected. When eating, pay attention to distinguish whether the color and taste of food are abnormal, do not eat foods with abnormal senses, "novelty" and "game", do not overeat, and limit drinking.

The third is to pay attention to personal hygiene habits. Establish a scientific and civilized consumption concept, pay attention to personal hygiene, wash your hands before meals, use sterilized tableware, advocate sharing meals with public chopsticks and spoons, and reduce the risk of cross-contamination at dinner.

Fourth, we should pay attention to safeguarding our own rights and interests. When food safety problems are found, the problem food and consumption bills should be kept well, and complaints should be made to 12315 or the local market supervision department in time. In case of suspected food poisoning, you should seek medical attention in time and keep relevant evidence so that relevant departments can investigate and collect evidence.

The fifth is to ensure the safety of self-hosted family banquets. For collective dinners hosted by rural families, chefs with health certificates and trained qualifications should be selected to host the banquets. Rural dining places should be clean and hygienic, the purchased and used food and raw materials should be of clear source and qualified quality, the food should be cooked thoroughly, and the perishable food and cooked food should be stored in a reasonable way.

Reporter: Liu Qu

Correspondent: Zeng Li Guo Shanshan

Original title: "Do you have a safe reunion dinner? The provincial market supervision bureau raided food safety.

Everyone has a love of beauty. In the era of Yan value economy, consumers’ pursuit of beauty supports the sustained growth of the beauty industry. However, in a long historical period, foreign brands have always occupied a dominant position in China’s beauty market, and the late-developing domestic brands can only catch up with each other in this marathon.

However, the competitive landscape is changing. In recent years, the rise of domestic beauty cosmetics has accelerated, and the market penetration rate has steadily increased. Last year’s "double 11", a report card made everyone shine-domestic brands surpassed international brands for the first time and won the beauty category titles on Tmall and Tik Tok platforms. In the context of the general decline of foreign brands, domestic beauty products have achieved contrarian growth. The "proud" performance is not only driven by the new trend in the consumption field, but also depends on the strong investment of domestic brands in ingredient research and development, the continuous pursuit of cost performance and the gradual improvement of brand strength.

Recently, In the "Times Meeting Room" column, the reporter had an in-depth conversation with Sun Huaiqing, Chairman and CEO of the Board of Directors, and Xu Xiaofang, Chief Analyst of Beauty and Commerce of CITIC Securities Research Department, to analyze the reasons behind the rise of domestic beauty products, discuss how technology can reshape the competitive landscape of China’s beauty industry in the "Composition Age", and look forward to the investment opportunities of beauty track in 2024.

In the "Times Meeting Room" column, the reporter had an in-depth conversation with Sun Huaiqing, Chairman and CEO of the Board of Directors, and Xu Xiaofang, Chief Analyst of Beauty and Commerce of CITIC Securities Research Department, to analyze the reasons behind the rise of domestic beauty products, discuss how technology can reshape the competitive landscape of China’s beauty industry in the "Composition Age", and look forward to the investment opportunities of beauty track in 2024.

Leading the "Component Age" with "Chip-level Revolution"

"2023 is the first year of China cosmetics, and it is also the origin of national brands surpassing multinational brands in an all-round way." Sun Huaiqing said that during several major e-commerce promotion activities last year, there was an obvious "trade-off" in the sales growth rate of national brands and multinational brands. On the one hand, some national brands have gained dozens of points of growth; On the other hand, some international brands have experienced a bleak performance decline.

According to the data of China Cosmetics Yearbook 2023, the domestic cosmetic market in China in 2023 is larger than that of foreign brands. It is worth noting that this is also the first time that domestic brands have surpassed foreign brands in online and offline channels. In Sun Huaiqing’s view, "this is not the end" and the trend will continue.

What does domestic beauty accelerate to catch up with? Both Sun Huaiqing and Xu Xiaofang frequently mentioned the progress of raw materials and the rise of local ingredients. "In the past few years, we have paid attention to the rise of a number of local bioactive raw materials suppliers in China, which can provide high-quality and low-cost raw materials for downstream brands to add in sufficient quantities. This laid a solid foundation for the product strength of domestic beauty products. " Xu Xiaofang said.

In recent years, Chinese consumers’ awareness of ingredients has deepened, and the demand for skin care products has advanced towards more personalized segmentation. Recombinant collagen is the "new top flow" in the current functional skin care track. Especially in recent days, international big names have entered the market one after another, betting on recombinant collagen components. LVMH’s private equity fund led the domestic recombinant collagen enterprises in September last year, and L ‘Oreal also introduced recombinant collagen into new products in December last year. According to the global growth consulting firm Jost Sullivan, in 2025, the market share of recombinant collagen will surpass hyaluronic acid and become the first raw material component of skin care products.

In the cosmetics industry, raw materials and ingredients have always been regarded as the "soul", which is also the shortcoming and weakness of China cosmetics companies in the past. However, in the component of recombinant collagen, local domestic brands have played the role of "leader". "Marumi announced in 2021 that China is leading the world in the research of recombinant collagen, and we are long-term practitioners, cultivators and leaders of this ingredient." Sun Huaiqing said.

Anti-aging is the rigid demand of skin care products. The essence of aging is the loss of human collagen. To resist aging, it is necessary to prescribe the right medicine and supplement collagen. At present, animal-derived collagen is widely used in skin care products because of its low cost and simple process. According to Sun Huaiqing, animal-derived collagen has three natural pain points: first, extracted from animal leather, it is inevitable that there is solvent residue, which is not gentle enough; Second, animal products may carry pathogens and are not safe enough; Third, animal collagen and human collagen are not the same species, and the absorption effect is not good enough.

"In order to solve these problems, there are many skin care products that stimulate the skin to produce collagen by using ingredients such as retinol or peptides. Through more than 10 years of research, we have synthesized humanized collagen similar to collagen in human skin by gene recombination, which can directly supplement the collagen lost by human body. " Sun Huaiqing said.

Chip is regarded as the key to China’s breakthrough in the field of science and technology, and Sun Huaiqing regards the success of component research and development as a "chip-level revolution". "The change brought by China brand to China cosmetics industry is a’ chip-level revolution’. This is the goal we are striving for and what is happening now. " Sun Huaiqing said.

"It’s not that foreign goods can’t afford it, but that domestic products are more cost-effective." "You can buy expensive ones, but you can’t buy expensive ones." … Under the background of the rise of generation Z and the change of consumption concept, the global consumer industry has ushered in profound changes, and the behavior pattern of the younger generation of consumers has changed from blindly advocating big brands to rational consumption and pursuing cost-effectiveness.

This trend in the field of consumption is undoubtedly a great opportunity for domestic beauty.

"At this stage, China Cosmetics fits consumers’ pursuit of cost performance very well." Xu Xiaofang told reporters that the booming raw material supply in the upstream provided raw materials with reasonable price, high activity and high purity, which enabled the downstream cosmetics brands to make skin care products with the same effect as international brands, and the price was more advantageous, thus better meeting the needs of consumers in China.

In the past, domestic beauty cosmetics gave people the impression that they were "big brands and cheap bowls". Is the current popular "cost performance" another synonym for low quality and low price? Sun Huaiqing gave a clear negative answer to this question. In his view, consumers have grown more savvy, and savvy consumers always hope that the money they pay is valuable when buying goods. High cost performance does not mean that the absolute price is low, but that the quality of this product brings consumers "sex" far higher than "price".

Take Marubi’s recombinant collagen mini-golden needle essence product as an example. According to Sun Huaiqing, the current price of this product is between 300 yuan and 400 yuan, but other products with similar efficacy and skin care experience on the market may cost 500 yuan to 600 yuan. Comparing the two, Marumi’s products are more cost-effective. "Cost performance has nothing to do with the absolute value of the price, but with the experience, feeling and change it brings to people. Marumi is a firm follower, practitioner and leader in cost performance. " Sun Huaiqing said.

Xu Xiaofang also observed that with the all-round progress of domestic beauty cosmetics in raw materials, packaging and marketing, the prices of many local cosmetic brands are gradually increasing. "Five years ago, the unit price of many mainstream local brand goods was around 100 yuan, and now it has gradually expanded to 200 yuan and higher price bands. But the current price is not too high, so it still has a strong cost performance for consumers. " Xu Xiaofang said.

At the same time, with the generation Z, represented by the post-90s generation, gradually becoming the main consumer in the field of beauty cosmetics, the new generation of consumers are more rational and smart in their consumption behavior, with stronger national self-confidence and higher willingness to try local brands, which provides broad opportunities for the rise of domestic beauty cosmetics.

Sun Huaiqing told reporters that the average penetration rate of cosmetics among post-90s consumers in China has exceeded that of foreign consumers, which means that their demand for skin care and make-up is stronger. What this generation has seen is a prosperous and prosperous China, which not only has economic self-confidence, but also gains cultural self-confidence in the process of growing up. The founders and operators of China brand know China consumers better and are better at emotional interaction with China consumers than multinational brands, so they have more advantages.

In recent years, the competition in the booming beauty industry has become increasingly fierce, and a number of cutting-edge brands have risen rapidly, which are favored by young consumers and have a very strong growth momentum. In this regard, as a domestic brand with a history of more than 20 years, Sun Huaiqing believes that Marumi still has strong vitality. "In a forest, vines, vines and ferns often grow fastest, but the trees have the strongest vitality." Sun Huaiqing said that the continuous investment in R&D, perfect supply chain, abundant capital reserves, a team of over 1,000 people with common values, and a basic customer base of over 10 million people are all the advantages and confidence of Marumi. "Only when the roots are deep will the trees grow tall." In Sun Huaiqing’s view, Marumi is the big tree in the forest with its roots deeply rooted in the ground.

Although in 2023, domestic beauty products achieved many surprising results in terms of increasing domestic market share and "sailing out to sea", in the secondary market, the beauty sector as a whole was in a downward channel in the past year. There is a certain degree of deviation between the industry performance and the valuation trend of the secondary market.

In this regard, Xu Xiaofang said that the rise and fall of stock prices is not only related to the fundamental situation of the industry and the company, but also the result of the comprehensive effects of valuation, capital movements, policy changes and other factors. In the past few years, the valuation of the entire beauty plate has experienced a period of continuous increase. In 2023, the valuation ushered in adjustment and decline, and the reflection on the stock price was also obvious. "But from a longer time axis, the price of the stock will definitely reflect the real value of the company in the end." Xu Xiaofang said.

"I boldly predict that in the next 5-7 years, the sales of China brand in China market will completely surpass those of multinational brands." Sun Huaiqing told reporters. At the same time, he predicted that three to five world-class cosmetics groups would be born in China no later than 2049. Based on this judgment, he believes that smart and far-sighted investors will use their own money to cast brands that they think are worth investing in. Therefore, the value of an excellent company will eventually be reflected in the stock price.

"Looking forward to 2024, we will continue to maintain confidence in the beauty industry, which is expected to continue to grow steadily." Talking about the investment opportunities in 2024, Xu Xiaofang judged this. Specifically, she believes that investors can pay attention to some structural opportunities when laying out the beauty track, and there are three main lines to focus on: first, continue to follow the main line of cost performance, second, make beauty science and technology, and third, pay attention to a group of China local raw material enterprises that are rising in the upstream of the industrial chain.

"One thousand hopes, one hundred percent happiness."

"Buy more, buy less, buy as much as you want, and you will win sooner or later." … …

Previously, walking on the street, you can often see similar slogans hanging outside the lottery betting station; In the betting station, many lottery players get together to exchange experiences. But now, is such a scene less and less common? In June this year, the national lottery sales totaled 34.767 billion yuan, a decrease of 23.862 billion yuan or 40.7% over the same period of last year. Not only did the monthly data decline, but combing the lottery sales data in the past decade found that the lottery sales showed negative growth year-on-year for the first time in the first half of this year. What causes the lottery market to be cold? What is the future trend of lottery market?

In the first half of the year, national lottery sales fell first.

From January to June this year, the national lottery sales totaled 212.596 billion yuan, a year-on-year decrease of 32.602 billion yuan or 13.3%. Among them, the sales of welfare lottery institutions was 97.757 billion yuan, a year-on-year decrease of 12.838 billion yuan or 11.6%; The sales of sports lottery institutions reached 114.839 billion yuan, a year-on-year decrease of 19.764 billion yuan or 14.7%.

Combing 2010 — The lottery sales data in the first half of the decade in 2019 found that this was the first year-on-year decline.

Judging from the monthly data, in June this year, the country sold a total of 34.767 billion yuan of lottery tickets, down 40.7% from the same period of last year. The year-on-year decline was mainly due to the large sales of quiz lottery games in the World Cup in June 2018, with a high base in the same period last year. In the first half of 2018, lottery sales increased by as much as 19.6%. Looking back on the past decade, the lottery market experienced a double-digit rapid growth period in 2010-2012, maintaining a high growth rate of more than 20%; In 2013 and 2014, the growth rate of national lottery sales fell below 20%; From 2015 to the first half of 2017, the growth rate of national lottery sales dropped significantly, only 5.2%, 3.5% and 5.5% respectively. Negative growth occurred for the first time in the first half of 2019.

Where do people prefer to buy lottery tickets?

Geographically, data from the Ministry of Finance show that in June this year, lottery sales in 31 provinces (autonomous regions and municipalities directly under the Central Government) all declined compared with the same period of last year.

However, from the cumulative data in the first half of the year, lottery sales in five provinces increased year-on-year, namely Sichuan, Shanghai, Henan, Anhui and Beijing, with an increase of 1.681 billion yuan, 234 million yuan, 190 million yuan, 172 million yuan and 45 million yuan respectively. As far as the overall sales volume in the first half of the year is concerned, Guangdong, Jiangsu, Shandong, Zhejiang and Henan rank among the top five in the country.

Strengthen the supervision of high-frequency fast-opening games

Why did lottery sales decline in the first half of this year? An expert in the lottery industry analyzed that at the beginning of this year, in order to regulate the lottery market, the Ministry of Finance, the Ministry of Civil Affairs and other departments strengthened the supervision of high-frequency quick-opening games and quiz games, extended the sales time of high-frequency quick-opening games and reduced the number of lottery games.

High-frequency fast-opening games mainly complete the process from sales to lottery every few minutes or ten minutes through electronic equipment. The data shows that in 2017, the share of Fucai quick-opening games in the total sales volume of Fucai reached 40%. In that year, the total sales volume of national welfare lottery was 216.977 billion yuan, of which the sales volume of quick-opening games was 87.522 billion yuan. A lottery player said: "The number of high-frequency fast-opening games is small, there are many awards, and the lottery is frequent. Many domestic lottery buyers are speculative when buying high-frequency fast-opening games. Some lottery buyers can play all day and easily lose their minds."

In January this year, the Ministry of Finance, the Ministry of Civil Affairs, and the General Administration of Sports issued a notice requesting to adjust the rules of high-frequency fast-opening lottery games and quiz lottery games and strengthen the supervision of the lottery market. According to the notice, in recent years, China’s lottery industry has generally shown a sustained and healthy development trend. At the same time, there are still irrational lottery buying phenomena in the lottery market, such as unauthorized use of the Internet to sell lottery tickets and large bets. In particular, the market supervision of welfare lottery quick-opening games, sports lottery high-frequency games and sports lottery national online single-game quiz games needs to be strengthened.

The notice is clear. From February 11th, if the sales time of high-frequency quick-start games is shorter than 20 minutes, it will be adjusted to 20 minutes. Since 2019, the number of contests and events for the annual quiz game shall not be higher than 70% of the number of contests and events for sale in 2018.

The above-mentioned experts also pointed out that the main reason is that there was a World Cup in June 2018. At that time, the sales volume of SMG was particularly large, which also boosted the sales volume of sports lottery. However, there were no important sports events in June this year. The sharp decline in sports lottery sales in June was an important factor in the decline in lottery sales in the first half of the year.

Internet lottery was banned.

The ban on internet lottery sales also has an impact on lottery sales. In August 2018, the Ministry of Finance and other 12 departments jointly issued a document, resolutely prohibiting the unauthorized use of the Internet to sell lottery tickets.

Internet lottery had previously shown a blowout growth trend in 2014. The huge sales volume of nearly 100 billion yuan makes internet lottery purchase an important force to promote the development of lottery market.

In 2014, Internet lottery experienced a glorious period. Major sports events, including the World Cup in Brazil, boosted the sales of Internet lottery by 102% from 42 billion yuan in 2013 to 85 billion yuan, accounting for 20% of the total lottery sales. According to the Analysis Report of Internet Lottery Market in 2014, there were more than 100 million users in China who bought lottery tickets through Internet channels, and the Internet became an important betting platform and channel for users.

Since then, since 2015, the Ministry of Finance and other departments have repeatedly issued a document to prohibit the sale of lottery tickets through Internet channels. However, during the 2018 World Cup, a large number of mobile apps illegally sold lottery tickets through the Internet.

At that time, there were many fish that escaped from the net without being investigated. According to reports, through the search of "lottery" in Android and Apple mobile phone stores, some apps have stopped selling lottery tickets, but there are still many softwares that can buy lottery tickets. In the early days of the World Cup last year, many companies launched online lottery platforms again. Finally, many online football lottery platforms such as "Winning the lottery every day" and "Everyone Winning the lottery" stopped selling on June 20 last year.

Standardize the management of welfare lottery issuance

The corruption case of Fucai Center exposed last year aroused social concern. On November 9, 2018, the website of the Central Commission for Discipline Inspection published a heavy article: "Pay equal attention to reduction and suppression, treat both the symptoms and the root causes, rebuild the credibility of Welfare Lottery, and the discipline inspection and supervision team stationed in the Ministry of Civil Affairs will promote the formation of a good political ecology from typical cases", with more than 4,000 words, and released confession videos of four former leaders of China Welfare Lottery Issuance Management Center.

After the corruption case of Welfare Lottery, the Ministry of Civil Affairs has improved the management system of welfare lottery issuance, sales, distribution and use of public welfare funds, such as changes in the internal institutions in charge of welfare lottery management.

On July 29, the Ministry of Civil Affairs held a press conference, and the relevant person in charge introduced that there are three main reform directions in regulating the issuance and management of welfare lottery tickets. First, cooperate with the Ministry of Finance, comprehensively rectify the unauthorized use of the Internet to sell welfare lottery tickets, and comprehensively conduct self-examination and inspection of national welfare lottery institutions and consignment agents. Second, vigorously adjust the rules of the quick opening game of welfare lottery to resolve the market risks of welfare lottery. The third is to improve the welfare lottery issuance management system. According to Economic Daily

CCTV News:According to the website of the National Bureau of Statistics,Issued by the National Bureau of Statistics1-mdash in 2023; The basic situation of the national real estate market in September.

I. Completion of investment in real estate development

1— In September, the national investment in real estate development was 8,726.9 billion yuan, a year-on-year decrease of 9.1% (calculated by comparable caliber); Among them, residential investment was 6,627.9 billion yuan, down 8.4%.

1— In September, the housing construction area of real estate development enterprises was 8,156.88 million square meters, a year-on-year decrease of 7.1%. Among them, the residential construction area was 5,742.5 million square meters, down by 7.4%. The newly started building area was 721.23 million square meters, down by 23.4%. Among them, the newly started residential area was 525.12 million square meters, down by 23.9%. The completed housing area was 487.05 million square meters, an increase of 19.8%. Among them, the completed residential area was 353.19 million square meters, an increase of 20.1%.

Second, the sale and sale of commercial housing

1— In September, the sales area of commercial housing was 848.06 million square meters, down by 7.5% year-on-year, of which the sales area of residential housing decreased by 6.3%. The sales of commercial housing was 8,907 billion yuan, down by 4.6%, of which residential sales fell by 3.2%.

At the end of September, the area of commercial housing for sale was 645.37 million square meters, up 18.3% year-on-year. Among them, the residential area for sale increased by 19.7%.

Three, the real estate development enterprise funds in place

1— In September, real estate development enterprises received 9,806.7 billion yuan, down 13.5% year-on-year. Among them, domestic loans were 1.21 trillion yuan, down by 11.1%; The utilization of foreign capital was 3.6 billion yuan, down by 40.0%; Self-raised funds were 3,125.2 billion yuan, down by 21.8%; Deposits and advance receipts were 3,363.1 billion yuan, down 9.6%; Personal mortgage loans reached 1,702.8 billion yuan, down 6.9%.

Fourth, the real estate development boom index

In September, the real estate development boom index (referred to as "national housing boom index") was 93.44.

Cctv news (Reporter Li Wenliang) Selling a car and then having it stolen, even a car was sold for three times. Recently, the police in Jinan, Shandong Province lasted for half a year, starting with a car theft case, and destroyed a 30-member criminal group headed by Wang.

Wu Yanbing, deputy head of the Criminal Police Brigade of Lixia Branch of Jinan Public Security Bureau, said that during his 10 years in Jinan, the suspect Wang gradually evolved from an ordinary taxi driver into the chief criminal of a criminal group involved in black and evil. They formed a stable organizational system "Zhengdian Gang" by wooing fellow villagers, fighting, picking fights, extortion, theft and robbery, which greatly damaged the legitimate interests of the masses and had extremely bad social impact.

Selling cars and stealing cars, another case, the fugitive suspect is now in the air.

On January 22, 2018, Lixia police received a report from the victim Li Moumou that a black Magotan sedan mortgaged by a bank was previously purchased from Wang and others at a low price of 105,000 yuan, but the car could not be used normally due to incomplete procedures. Later, Li Moumou entrusted Wang and others to help sell the car, and the car was stolen during the sale.

After receiving the case, the First Squadron of Lixia Interpol quickly launched an investigation. On July 2, 2018, the car appeared in Tianjin, and the police immediately rushed to Tianjin and found that the actual user of the vehicle was Mu Mouhui, who was a cousin of Wang, both of whom were from Zhengdian, Laoling, Shandong Province. The police comprehensively analyzed and judged that the suspicion that Wang and others sold cars first and then stole them rose rapidly.

Subsequently, the police conducted an investigation around Wang and the people around him, and determined that the theft of the black Magotan car was the work of Zhang Mouzhi. Following this clue, it was found that Zhang Mouzhi was one of the fugitives who sought trouble with Wang and others in the police station area of Keyuan Road. On July 25, 2018, the police arrested Zhang Mouzhi.

The picture shows the police arresting the scene. (Photo courtesy of Lixia Public Security Bureau of Jinan City)

Uncover the curtain of criminal groups

After in-depth investigation, the police found that this was not a simple car theft case, but a criminal gang involving more than 30 people headed by Wang, with Zhang Mowen, Zhang Mozhi, Zhang Mobin, Sun Moudong and Xia Mouyun as the backbone.

Wu Yanbing introduced that Wang, the leader of the gang, drove a taxi from Zhengdian, Laoling, to Jinan in 2008. He operated well and earned a lot of money. Later, Zhengdian’s fellow villagers all came to him. Wang anchored more than 20 cars in a taxi company. The fellow villagers who defected first took driving taxis as their main business, and formed an influential "Zhengdian Gang" in the taxi industry in Jinan, with a stable organizational system.

Through long-term covert development, the criminal gang gradually completed primitive accumulation of capital by operating hotels, business hotels and taxi companies as economic sources, and formed an enterprise management and business model. In the meantime, in the name of recruiting hotel waiters and taxi drivers, more than 30 members were developed.

In the daily management, the members of the gang use WeChat group, QQ group and taxi radio as contact methods, and contact in real time. Once people are needed to commit illegal crimes, people will be gathered immediately, which will have a quick response, many members and great social harm.

During his hotel management in Jinan, Wang bullied the city and competed viciously. In order to monopolize the regional market, he organized and implemented a large-scale affray. In April 2017, Wang, Zhang Mowen and Sun Moudong jointly invested to run a hotel in Heping Road, Lixia District. Because of the competition for tourists, they repeatedly had conflicts with the owner of an adjacent hotel. On May 11, 2017, there was a conflict between the two sides. Wang gathered more than 20 people at the entrance of the other hotel, and the two sides confronted each other, with more than 60 participants, and the social impact was extremely bad.

In addition, on April 19, 2017, the criminal gang was in a hotel on Huanshan Road, which also disturbed public order and caused trouble because of competition.

The picture shows the suspect being interrogated. (Photo courtesy of Lixia Public Security Bureau of Jinan City)

The gang "transformed" and falsely sold mortgage cars.

In the early days, the gang mainly disturbed public order and made troubles. In the past year, it gradually developed into crimes such as robbery, extortion and theft. In order to achieve the purpose of illegally accumulating wealth and obtaining benefits, the gang committed crimes continuously and repeatedly.

From September 2017 to January 2018, the criminal suspects Wang, Zhang Mouwen, Zhang Mobin, Xia Mouyun and others discussed together, and Wang invested to buy a bank-mortgaged vehicle. After buying the car, he assembled a locator and reserved a car key. After selling the car, he stole the vehicle back; Or, Xia Mouyun posted the information about selling mortgage cars on the Internet, and forged the relevant procedures of the car. When the buyer came to Jinan to trade, he defrauded the car purchase money and then gathered people to grab the car back.

In the name of falsely selling the mortgage car, the gang snatched, stole and cheated the mortgage car back by means of theft, robbery and fraud after selling the car or during the transaction. The car was sold six times, and one of the Volkswagen Tiguan cars was repeatedly sold three times.

At present, the criminal group headed by Wang has been smashed by the police. Since July 25, 2018, the police have arrested 28 illegal and criminal members of the group, including 21 people arrested and 7 people released on bail pending trial. It was initially verified that there were 9 criminal cases involving robbery, affray, theft, etc., and the property involved was worth more than 2 million yuan. What was waiting for them would be legal sanctions. (This article thanks Zhao Yang for providing the material)