How long has it been since you went to the beauty shop?

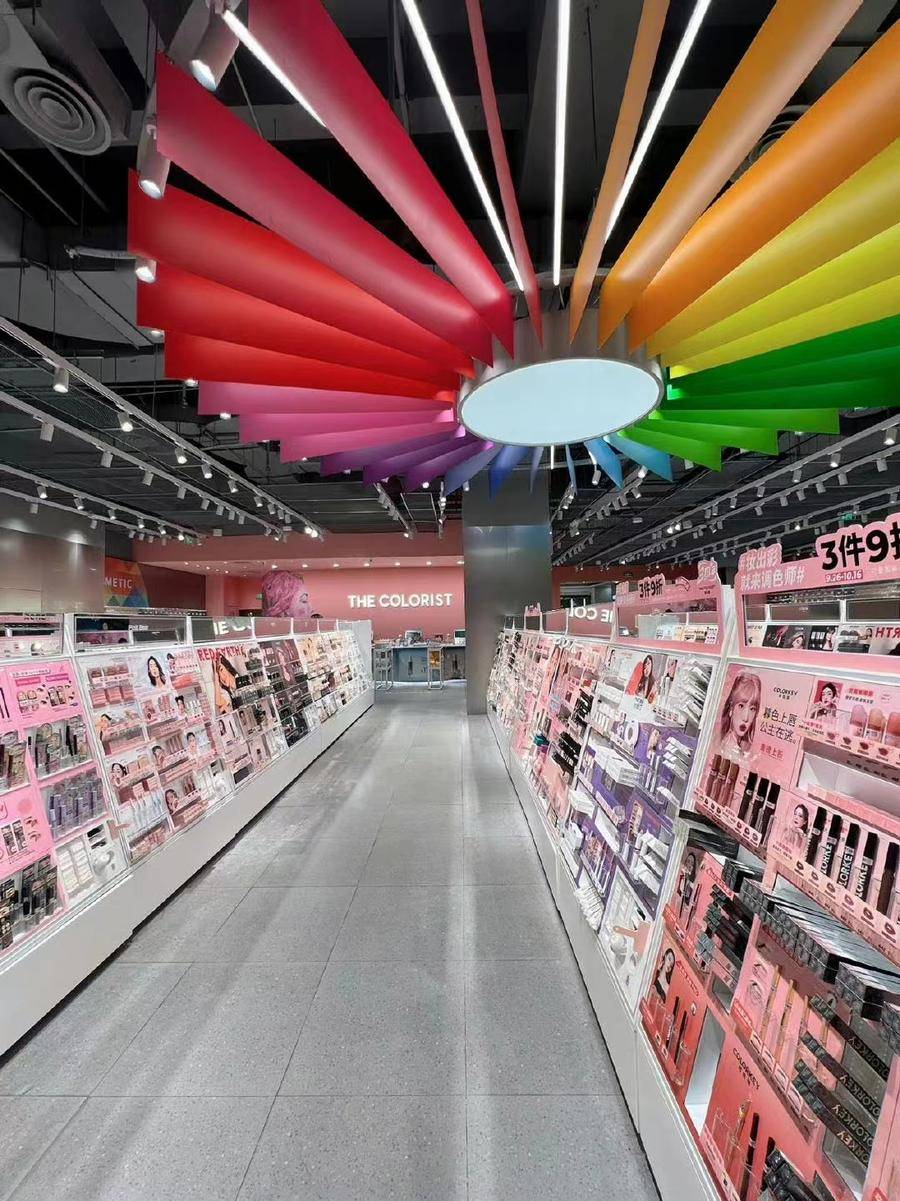

Li Si (a pseudonym), a white-collar worker in Shenzhen, was once the "iron powder" of the beauty collection shop. In the first two years when the beauty collection shop was the hottest, she went to the first colorist in Shenzhen with her friends to try on lipstick, punch in and take photos, and often visited chain brand stores like KKV and Jinliang Life.

"In the past two years, I really liked to visit Jinliang Life. It has a complete range of cosmeceuticals, and the decoration style is also my favorite ins style. There is also a tea partition, so I can have a rest when I am tired. But when I go again this year, I feel that skin care samples are not as many brands as before, and there are almost no people in the store. " Li Si said bluntly.

The depression of stores is not groundless. Recently, Jinliang Life announced that it will close all offline stores before December 31, 2022, focusing on online business. According to the notification letter provided by the online transmission supplier, Jinliang Life blamed the decision to close the store on the continuous impact of the epidemic.

It is reported that Jinliang Life is a beauty collection store brand founded by Steady Medical in 2019, with more than 2,000 products on the store shelves, covering skin care, make-up, fragrance, personal care, home cleaning and other categories. By the end of 2021, Jinliang lived in 10 stores all over the country.

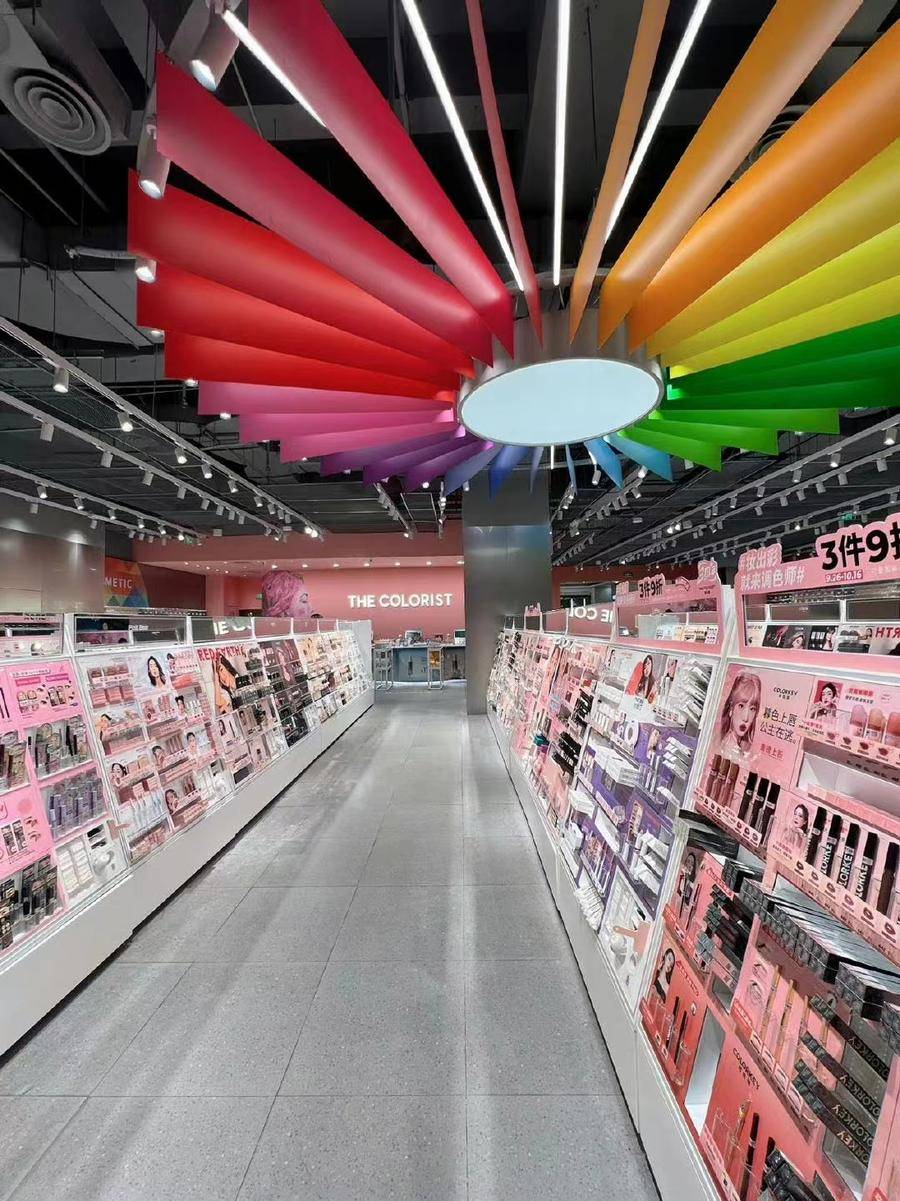

The retreat of Jinliang’s life is just the epitome of the collective "flameout" of beauty collection stores. Since last year, the new beauty collection stores such as THECOLORIST Colorist, HAYDON Black Hole and KKV have closed down one after another to varying degrees, while the traditional head beauty collection stores Sasha, Watsons and Zhuo Yue have also suffered from sluggish performance and are deeply mired in business bottlenecks.

Can the wind of the beauty collection shop still blow?

The beauty cosmetics collection shop has a hard time.

Looking back on the past, the new and old beauty collection stores were once bustling and brilliant.

In 2019, the new beauty collection store quickly became popular with its high value, low price and complete categories, and brands such as HAYDON Black Hole, WOW COLOUR and Colorist set off a wave of queuing and punching. As early as the golden age of free travel in Hong Kong more than ten years ago, Zhuo Yue, Sasha and Watsons were important places for countless tour groups, purchasing agents and young consumers to buy cosmeceuticals.

Nowadays, the beauty collection store is undergoing a crisis of survival and closing the store again and again.

In May of this year, HAYDON Black Hole closed three stores successively; The number of WOW COLOUR stores has also been reduced from more than 300 at the peak to more than 100 today, and the number of stores has been folded.

In addition, KKV and colorist THE COLORIST continue to close stores. In the first half of 2021 alone, KKV has closed 44 franchisees, while THE COLORIST has closed 59 franchisees. According to the reporter of Time Weekly, THE COLORIST has three stores in Guangzhou, and the Wanlinghui store has been closed before.

On the other hand, Watsons, Salsa, Zhuo Yue and other traditional beauty collection stores can’t escape the fate of a sharp drop in performance.

According to the financial report for the first half of 2022, Watson’s China market sales were 9.685 billion Hong Kong dollars, down 17% year-on-year; Earnings before interest and tax achieved HK$ 623 million, down 60% year-on-year.

According to the financial report, in the six months to September 30, 2022, Sasha International’s turnover reached HK$ 1.55 billion, down 2.9% year-on-year, with a loss of HK$ 133 million during the period. Among them, the retail sales in mainland China dropped by 13.1% to HK$ 120 million.

In the financial report, Sasha attributed the decline in performance in China to the loss of stores, pointing out that during the reporting period, despite the closure of stores that recorded losses during the reporting period and efforts to reduce operating costs, the business in China was still dragged down, and the loss increased by 5.1% year-on-year to HK$ 44 million.

In terms of the number of stores, the number of Watsons stores decreased by 124 in the first half of this year. As of September 30, 2022, the total number of international retail stores in Shasha has decreased from 234 to 193, with the largest number of stores closed in mainland China, with 35 stores reduced and 42 remaining.

In addition to the decline in performance, stores are closed, and more traditional beauty collection stores are facing bankruptcy.

In April this year, Zhuo Yue released its annual report for fiscal year 2021, showing that the company achieved operating income of HK$ 627 million, up by 16.37% year-on-year, and the net loss attributable to the parent company was HK$ 208 million, down by 18.63% year-on-year. In June this year, Zhuo Yue officially announced the suspension of trading on the Hong Kong Stock Exchange; In September, Ye Junheng, the founder of Zhuo Yue, and his wife and son were also filed for bankruptcy by Fuying Co., Ltd., a subsidiary of Hongan Group.

The guest bill rate is worrying

The life of beauty collection stores is not easy, which is not unrelated to the "shrinking" of the domestic beauty retail market.

Statistics from the National Bureau of Statistics show that the total retail sales of cosmetics from January to October this year was 308.4 billion yuan, down 2.8% year-on-year. Since the beginning of this year, the growth rate of total retail sales of cosmetics has been maintained at the lowest level in five years, and it has been declining for three consecutive months. This kind of pressure from retail terminals has become one of the "straws" to crush beauty collection stores.

Affected by the epidemic situation, the downward trend of offline consumption, changes in shopping channels and other factors, the passenger flow of beauty collection stores has been greatly reduced, and the conversion rate of customer orders has been further reduced. Making ends meet is also the cause of a large number of closure of beauty collection stores.

Yang Ping (pseudonym) has worked in Shasha for many years, and is currently engaged in sales planning in a new beauty collection store enterprise. She told the Times Weekly reporter that in the past, the problem of low conversion rate of beauty collection stores mainly existed in new beauty collection stores. Traditional beauty collection stores had a certain customer base and were still "able to withstand", but with the emergence of a large number of social platforms such as Xiaohongshu and domain bloggers in the past two years, and the rise of live broadcasts and short-sighted band goods, new and old beauty collection stores were separated by more than half of the customer lists online.

According to the data of Ai Media Consulting, the market size of China cosmetics industry will reach 455.3 billion yuan in 2021, and it is estimated that the market size of China cosmetics industry will reach 516.9 billion yuan in 2023. According to the survey data of Ai Media Consulting, 72.6% of consumers will buy cosmetics on the integrated e-commerce platform, and e-commerce will continue to be the main channel of major brands.

On the other hand, the homogeneity of the products sold and the lack of brand characteristics have also led to the collective "running" of beauty collection stores.

"Beauty collection stores like Sasha and Zhuo Yue mainly sell Japanese, Korean and European makeup. Compared with them, new beauty collection stores have more domestic brands of makeup. But even so, there are still too many identical products, and consumers are prone to aesthetic fatigue. There is no way to effectively stimulate consumption just by engaging in promotional offers. " Yang Ping explained.

Bai Yunhu, an expert in beauty management, said that there are some shortcomings in the "people’s goods yard" of today’s beauty offline collection stores, and there are still many problems in cultivating consumers’ minds, supply chain management and offline store scene design.

Beauty collection stores are collectively saving themselves.

HARMAY Huamei enhances its competitiveness by introducing new domestic brands such as Rose Manor, ChunShan Chunshan and East Beast from ANN’S ROSARY. WOW COLOUR will expand the diverse categories such as cosmetics, perfume, aromatherapy and toiletries on the basis of makeup and skin care, trying to open up the brand beauty product matrix; Watsons has continuously adjusted its store opening strategy, combined online shopping malls with offline stores, and started the O2O retail model by developing online operating tools such as WeChat official account, applets, and communities.

From the perspective of the industry as a whole, the beauty market still has room for improvement, and the beauty collection store is not desperate. In the face of the current predicament, how to regain the favor of consumers is the fundamental problem that beauty collection stores need to think carefully. (Time Weekly)