Profit growth ≠ The stock price is improving. Which beauty listed company will make the most money in 2023?

Text |C2CC New Media

As the year approaches, I believe we are most concerned about two things: First, the A shares that have repeatedly fallen below 2,800 points have made China investors "lose their shorts"; second, whether the annual meeting and the year-end bonus will be "a fart year" as Wang Jianlin said, or "don’t give up hope even if you lose everything in the secondary market, after all, there is still a tertiary market".

The good news is that according to the data released by the national statistics department, the gross domestic product (GDP) of China reached 126.06 trillion yuan in 2023, up 5.2% year-on-year, and the growth rate was 2.2 percentage points faster than that of 2022.

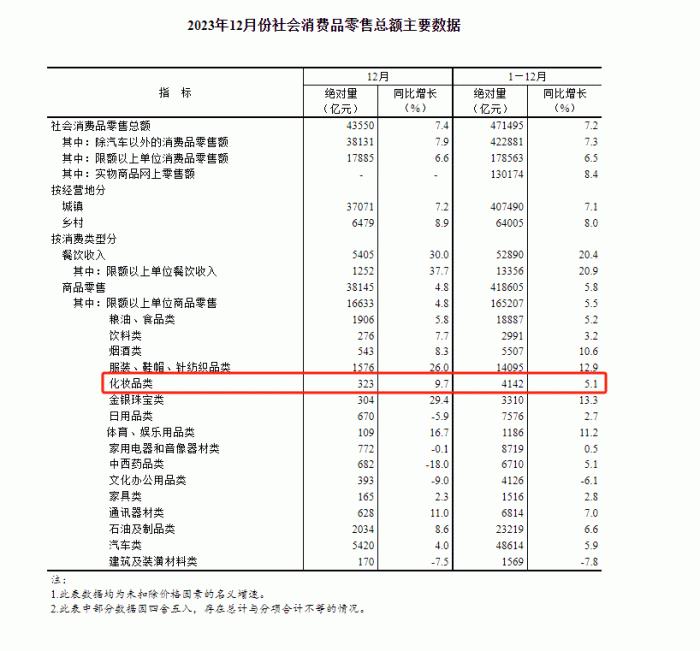

In addition, the National Bureau of Statistics released the domestic consumption data for the whole year of 2023. From January to December 2023, the total retail sales of social consumer goods was 47,149.5 billion yuan, an increase of 7.2% over the previous year. Among them, the retail sales of cosmetics was 414.2 billion yuan, up 5.1%, and the growth rate of cosmetics market did not outperform the market.

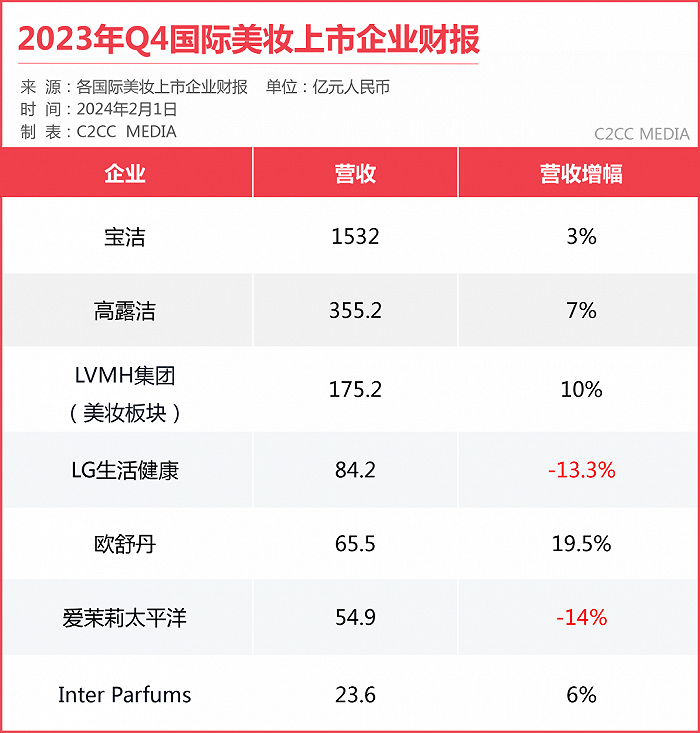

At the end of January, 2024, listed beauty companies at home and abroad released their 2023 financial reports and performance forecasts one after another. C2CC Media’s "Counting Beauty" column counted the relevant financial report data, and found that for domestic beauty companies, profit growth and turning losses into profits are the main melody melody, but it seems that profit growth can’t save the bleak capital market, while international beauty companies are mixed. Behind the performance growth, it is more through "price increase strategy" to offset the continuation of product sales.

We can also spy from the import and export data released by the General Administration of Customs in 2023. From January to December 2023, the total import and export value was 41.76 trillion yuan, up 0.2% year-on-year, of which the quantity and amount of cosmetics showed a double downward trend. From January to December, the import of beauty cosmetics and toiletries was 358,600 tons, down 14.2% year-on-year, and the total import value was 126.02 billion yuan, down 15.2% year-on-year.

01 domestic beauty listed companies: growth is the main theme.

1. Marubi shares: the net profit increased by 72-89% in advance, and the performance reached a new high.

On January 22nd, Guangdong Marubi Biotechnology Co., Ltd. (hereinafter referred to as Marubi) released the annual performance forecast for 2023.

The performance forecast shows that, according to the preliminary calculation by the financial department of the company, the net profit in 2023 is expected to be RMB 300 million to RMB 330 million (hereinafter all RMB), which will increase by RMB 126 million to RMB 156 million compared with the same period of last year, with an increase of 72% to 89%. It is estimated that in 2023, Marubi’s net profit after deducting non-recurring gains and losses attributable to the owners of the parent company will be 220 million yuan to 250 million yuan, which will increase by 84.05 million yuan to 114 million yuan compared with the same period of last year, with a year-on-year increase of 62% to 84%.

As for the growth of performance, Marubi said in the preview that the main reason was that the company actively promoted the transformation of online channels and better grasped the annual marketing rhythm. Among them, Marubi brand’s content e-commerce represented by Tik Tok Aauto Quicker increased by over 100%, and the second brand PL’s love for fire increased by over 100%.

2. Freda: The annual revenue exceeded 2 billion.

On January 23rd, Lushang Freda Pharmaceutical Co., Ltd. (hereinafter referred to as "Freda") released the annual performance forecast for 2023.

According to the performance forecast, according to the preliminary calculation by the financial department, it is estimated that the net profit attributable to shareholders of listed companies in 2023 will be 260 million yuan to 290 million yuan, an increase of 215 million yuan to 245 million yuan compared with the same period of last year, an increase of 472% to 538%.

It is estimated that the net profit of listed public shares after deducting extraordinary gains and losses will be 116 million yuan to 146 million yuan in 2023, which will increase by 58 million yuan to 88 million yuan compared with the same period of last year, with a year-on-year increase of 98% to 150%.

For the surge in net profit, Freda said that the core reason benefited from the divestiture of real estate development business, and at the same time, relying on solid scientific and technological research and development strength and the advantages of multi-brand omni-channel development, it constantly empowered the development of core business, especially the performance of cosmetics.

3. Shuiyang shares: the net profit doubled.

On January 18th, Shuiyang Company released its 2023 annual performance forecast.

The annual performance forecast shows that in 2023, Shuiyang Co., Ltd. is expected to achieve a net profit of 280 million yuan to 320 million yuan, a year-on-year increase of 124%-156%, and a non-net profit of 260 million yuan to 300 million yuan, an increase of 169%-210%.

For the reasons of high performance growth, Shuiyang believes that the overall business and product structure are further optimized, the brand matrix is perfect, and the proportion of high-margin brands continues to rise. At the same time, the company insists on refined operation, continuously improves management efficiency, continuously improves organizational system construction, and improves the effect of cost control.

4. Beauty and Beauty Makeup: Net profit turned into profit.

On January 30th, Liren Lizhuang disclosed the 2023 annual performance forecast.

The forecast shows that Liren Lizhuang expects to achieve a net profit of 28 million yuan to 35 million yuan in 2023, especially in the fourth quarter. The company turned losses into profits throughout the year and its business operations continued to improve.

Liren Lizhuang pointed out in the announcement that the company’s net profit attributable to shareholders of listed companies in 2023 turned into profit compared with that in 2022, mainly due to the growth of the company’s emerging channel business, the smooth progress of incubating brands, the improvement of inventory structure and the overall cost control.

5. Runben shares: The revenue scale continues to grow.

On January 24th, Runben shares released the 2023 annual performance forecast.

The forecast shows that Runben shares are expected to realize a net profit of 215 million to 235 million yuan in 2023, an increase of 34.34% to 46.83%; Non-net profit deduction is estimated to be 207 million to 227 million yuan, up 34.1% to 47.05% year-on-year. In Q4 alone, the company expects to realize a net profit of RMB 34-54 million, up by 17-86% year-on-year, and realize a net profit of RMB 30-50 million deducted from non-homecoming.

The report pointed out that the pre-increase in performance was mainly due to the company’s further expansion of baby care products and product matrix, and the proportion of baby care products further increased, which improved the overall profitability of the company. At the same time, the company continuously strengthened operation management and continuously improved operation management efficiency, and the sales expense ratio decreased year-on-year.

6. Ruo Yuchen: The net profit is expected to increase by nearly 62%

On January 29th, Ruo Yuchen released the 2023 annual performance forecast.

According to the report, it is estimated that the net profit attributable to shareholders of listed companies during the reporting period will be RMB 42 million to RMB 54.6 million, an increase of 24.42% to 61.75% over the same period of last year; Non-net profit was 41 million yuan to 53.6 million yuan, an increase of 29.01% to 68.65% over the same period of last year.

Ruo Yuchen said that the increase in operating performance in 2023 stems from the company’s strengthening of refined operations in 2023, reducing operating costs from multiple dimensions, strengthening control over expenses and budgets, improving overall operating efficiency, and improving the company’s costs and various expenses as a whole; In addition, in 2023, the operating income of its own brand "Zhanjia" increased significantly. During the reporting period, the introduction of new brands such as "Ai Weinuo", "Ai Ziran" and "Kang Wang" developed rapidly, which had a positive impact on the company’s operating performance.

7. Celebrity Health: The net profit may exceed 100 million yuan.

On January 29th, Mingchen Health Products Co., Ltd. (hereinafter referred to as "Mingchen Health") released the annual performance forecast for 2023.

The forecast shows that the estimated net profit attributable to shareholders of listed companies in 2023 is between 70 million yuan and 100 million yuan, compared with 25.33 million yuan in the same period last year, up by 176.35% to 294.79%. Non-net profit was between 65 million yuan and 95 million yuan, up 1462.68% year-on-year to 2091.61%.

8. Kesi shares: Net profit soared by nearly 96%

On January 15th, Nanjing Kesi Chemical Co., Ltd. (hereinafter referred to as Kesi) released the 2023 annual performance forecast.

According to the report, it is estimated that the net profit of returning to the mother in 2023 will be 720 million yuan to 760 million yuan, an increase of 85.5% to 95.8%; Deducting the net profit of non-returning to the mother was 703 million yuan to 743 million yuan, with an increase of 85.8% to 96.4%.

For the continuous high growth of performance and net profit in 2023, Kesi shares said in the forecast that due to the steady improvement of the company’s market position and the continuous growth of the market demand for sunscreen products, at the same time, due to the improvement of the company’s overall capacity utilization rate and the rapid release of the production capacity of new products represented by new sunscreen agents, it will eventually help the company’s main business income and gross profit margin level increase. In the future, KES will invest and build the "Malaysia Annual 10,000 Tons Sunscreen Series Product Project" in Malaysia to expand the market demand in Asia Pacific, Europe and other regions.

9. Aimeike: The annual net profit is nearly 2 billion yuan.

On January 5th, Aimeike released the 2023 annual performance forecast.

It is estimated that Aimeike will achieve a net profit of 1.81 billion to 1.9 billion yuan for the whole year, a year-on-year increase of 43% to 50%; Non-net profit was 1.782 billion to 1.872 billion yuan, up 49% to 56% year-on-year.

For the huge increase in net profit, Aimeike said in the preview that the company actively pays attention to market changes, provides high-quality services for downstream medical and beauty institutions at the academic and operational ends, better meets the needs of beauty seekers, and enhances the depth of cooperation with customers. At the same time, through the distribution model, it further expands the number of institutions covered by the company’s products and enhances the breadth of cooperation with customers.

10. Two-faced needle: the performance turned losses, and the net profit increased by over 147%.

On January 30th, "Toothpaste No.1" Double-sided Needle released the performance forecast for 2023.

According to the forecast, it is estimated that the two-sided needle will turn losses from January to December 2023, and the net profit attributable to shareholders of listed companies will be 18 million to 27 million yuan, with a year-on-year increase of 146.65% to 169.97%.

As for the turnaround in performance, the company said that in 2023, by opening up product sales channels and increasing product sales, the company’s profits increased accordingly. Among them, the operating income and net profit of its subsidiary, the hotel supplies business, increased significantly year-on-year.

11. Qingdao Golden King: Turn the net profit into profit.

On January 30th, Qingdao Jinwang Applied Chemistry Co., Ltd. (hereinafter referred to as "Qingdao Jinwang") disclosed the 2023 annual performance forecast.

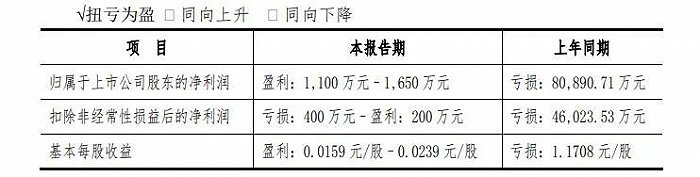

According to the forecast, it is estimated that the net profit of Qingdao Jinwang returning to his mother in 2023 will be 11 million yuan to 16.5 million yuan, with a loss of 809 million yuan in the same period of last year; Deducting non-net profit is expected to be-4 million yuan to 2 million yuan.

According to the data, Qingdao Jinwang’s main business is divided into three parts: new material candle and aromatherapy and craft products business, cosmetics business and supply chain business. Among them, new materials, candles, aromatherapy and craft products business and cosmetics business are the core business development sectors of the company.

Qingdao Jinwang said in the notice that the main reason for the change in performance was that the company’s cosmetics business gradually recovered in 2023, but some subsidiaries’ cosmetics business failed to meet expectations.

02 international beauty listed companies: mixed feelings

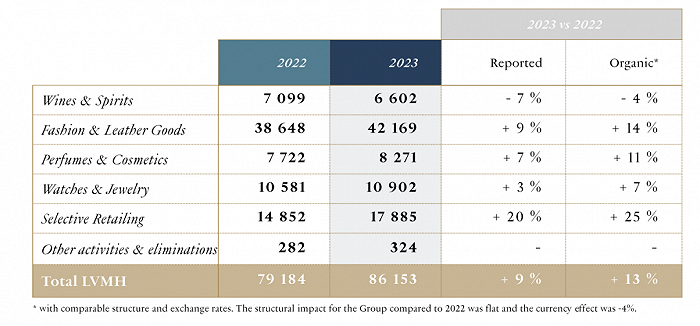

1. LVMH Group: perfume and beauty business increased by 7%.

On January 25th, LVMH Group announced its annual performance report for 2023.

According to the financial report, in the twelve months ended December 31st last year, LVMH Group’s sales revenue increased by 9% year-on-year to 86.2 billion euros (about 670.82 billion yuan), its gross profit rate was 69%, its operating profit increased by 8% to 22.8 billion euros (about 177.39 billion yuan), and its net profit increased by 8% to 15.2 billion euros (about 118.20 billion yuan). Among them, the annual sales of perfume beauty business increased by 7% to 8.27 billion euros (about 64.3 billion yuan), an organic increase of 11%; The selected retail departments where DFS and Sephora are located have benefited from the recovery of global tourism retail and become the best-performing business of LVMH. The annual revenue increased by 20% year-on-year to 17.9 billion euros (about RMB 139.21 billion), with an organic increase of 25%, and the operating profit increased by 76% to 1.4 billion euros (about RMB 10.88 billion).

In terms of regions, Asia is the largest consumer market of LVMH, and Asia including China (excluding Japan) contributed the highest revenue of 26.707 billion euros, accounting for 31% of the Group’s revenue, up 1% from 2022. The United States and Europe contributed 21.538 billion euros respectively, accounting for 25% of the Group’s revenue, of which the proportion of revenue in the United States decreased by 2 percentage points, while that in Europe increased by 1 percentage point; Japan’s revenue was 6.031 billion euros, accounting for 7% and 12% in other regions.

LVMH Group said in the financial report that although there are still uncertainties in the geopolitical and macroeconomic environment, LVMH is full of confidence in its ability to continue to grow in 2024, the highly unique quality and creativity of its products and the professionalism of its management, and believes that it can stand out and gain market share.

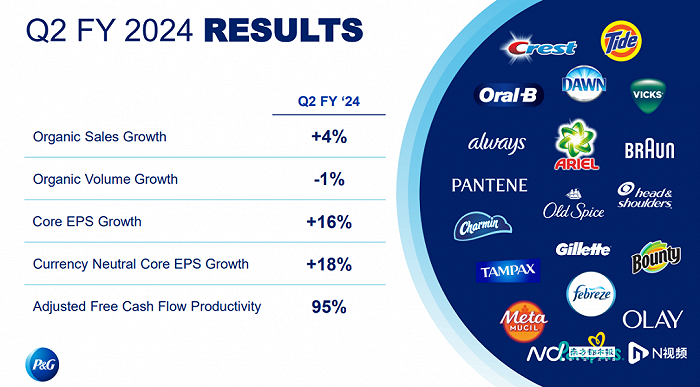

2. Procter & Gamble: The annual net sales exceeded 600 billion yuan for the first time.

On January 23rd, Procter & Gamble released the second quarter (September 2023-December 2023) and annual performance report of fiscal year 2024.

The report shows that in 2023, P&G achieved a net sales of 83.964 billion US dollars (about 601.1 billion yuan) and a net profit of 14.861 billion US dollars (about 106.4 billion yuan). Among them, the company’s net sales in the second quarter was 21.4 billion US dollars (about 153.2 billion yuan), an increase of 3% over the previous year; The net profit of returning to the mother fell by 11.8% year-on-year to 3.468 billion US dollars (about 24.8 billion yuan).

In terms of departments, the organic sales of Beauty department in the second quarter was US$ 3.849 billion (about RMB 27.590 billion), an increase of 1%. The organic sales of Health Care department was 3.172 billion US dollars (about 22.738 billion yuan), up by 2%. The organic sales of Grooming department for men was US$ 1.734 billion (about RMB 12.430 billion), up by 9%. The organic sales of Baby, Feminine &Family Care department was 5.146 billion US dollars (about RMB 36.888 billion), with an increase of 2%; Fabric &Home Care’s organic sales amounted to US$ 7.415 billion (about RMB 53.152 billion), an increase of 5%.

It is worth mentioning that P&G highlighted in its financial report that its sales in the second largest market, Greater China, dropped by 34% due to the slowdown in demand for high-end skin care brand SK-II and other products, mainly due to the impact of nuclear sewage discharge in Japan.

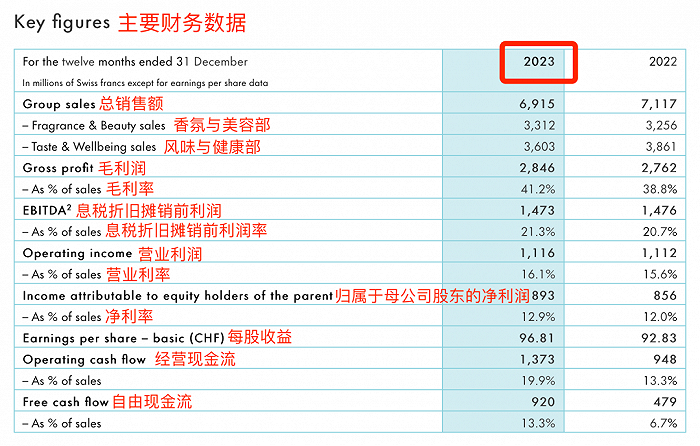

3. Chiwaton: The perfume business leads the growth.

On January 25th, the Swiss flavor and fragrance company Givaudan released its annual financial report for 2023.

According to the financial report, the total sales of Chihuaton in 2023 was 6.915 billion Swiss francs (about 57.481 billion yuan), up 4.1% year-on-year, and down 2.8% year-on-year in terms of Swiss francs. The annual sales of perfume and beauty department in 2023 was 3.312 billion Swiss francs (about RMB 27.531 billion), up by 7.6% year-on-year, and increased by 1.7% year-on-year in terms of Swiss francs.

Among them, the sales of high-end perfume increased by 14.0% year-on-year, the sales of consumer goods increased by 7.1% year-on-year, and the sales of essence components and active beauty business increased by 1% year-on-year.

In terms of regions, sales in Europe and the Middle East reached 2.717 billion Swiss francs (about 22.653 billion yuan) last year, up 8.4% year-on-year, ranking first; In the Asia-Pacific region to which China belongs, sales amounted to 1.698 billion Swiss francs (about 14.157 billion yuan), up 3.9% year-on-year; The total sales in North America reached 1.653 billion Swiss francs (about 13.782 billion yuan), down 6.8% year-on-year; Latin America has the fastest growth rate, achieving sales of 847 million Swiss francs (about 7.062 billion yuan), up 15.1% year-on-year.

Chiwaton said in the performance report that the good growth benefited from the sustained strong performance of high-end perfume business, the continuous high level of new business, the increase in pricing of all businesses and the increase in the growth rate of consumer goods business in the second half of 2023.

4. Inter Parfums: The annual net sales increased by 21%.

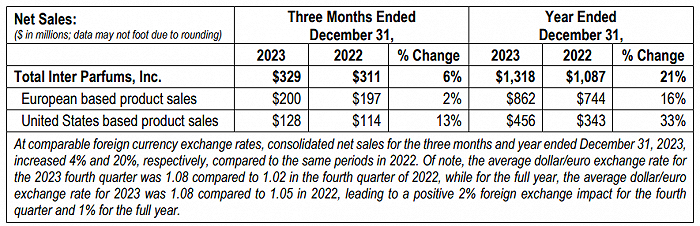

On January 24th, Inter Parfums, a perfume manufacturer, released its financial reports for the fourth quarter and 2023 as of December 31st, 2023.

The financial report shows that the net sales of Inter Parfums in the fourth quarter was 329 million US dollars (about 2.357 billion yuan), up by 6%. In 2023, the company’s overall net sales were 1.32 billion US dollars (about 9.455 billion yuan), an increase of 21%.

By region, the sales of Inter Parfums’ European business increased by 2% to 200 million US dollars (about 1.433 billion yuan) in the fourth quarter; The annual sales of European business reached US$ 862 million (about RMB 6.175 billion), up by 16%. In the fourth quarter, the sales of American business increased by 13% to US$ 128 million (about RMB 917 million), and the annual sales of American business was US$ 456 million (about RMB 3.266 billion), up by 33% year-on-year.

5. Colgate: Toothpaste accounts for 41.1% of the global market.

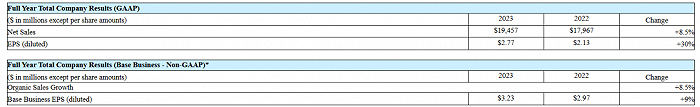

On January 26th, Colgate announced the financial performance data for the fourth quarter and the whole year of 2023.

The data shows that Colgate achieved net sales of 19.457 billion US dollars (about 139.612 billion yuan) in 2023, an increase of 8.5% year-on-year. In the fourth quarter, Colgate achieved net sales of US$ 4.95 billion (about RMB 35.518 billion), a year-on-year increase of 7%.

Colgate said in the financial report that its net sales and organic sales both increased by 7% in the fourth quarter, and it still maintained a leading position in the toothpaste industry and manual toothbrush field. Among them, the global market share in toothpaste industry accounts for 41.1%, and the global market share of manual toothbrushes accounts for 31.5%.

6. L ‘Occitane: China market contributed 21.9%.

On January 30th, L ‘Occitane Group released its financial report for the third quarter and the first nine months of fiscal year 2024 as of December 31st, 2023.

The financial report shows that L ‘Occitane’s sales in the first nine months reached 1,915.3 million euros (about 14,883 million yuan), an increase of 18.9% according to the reported growth rate and 24.8% according to the fixed growth rate. Net sales in the third quarter reached 843.4 million euros (about 6.554 billion yuan), an increase of 19.5% at the reported rate and 24.6% at the constant rate.

In terms of regional performance, the Asia-Pacific region grew by 6.7% in the nine months of fiscal year 2024, and the China market contributed a strong growth of 21.9%.

Regarding the steady sales momentum in the first nine months, L ‘Occitane said that the growth was mainly due to the continuous excellent performance of Sol de Janeiro, the positive performance of Elemis and the steady growth of L’Occitane en Provence in China.

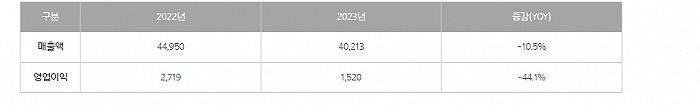

7. Amore Pacific: Double decline in performance and profit.

On January 30th, Amore Pacific Construction Group released its financial report for the fourth quarter and the whole year of 2023.

According to the financial report, in 2023, the group’s annual sales were 4,021.3 billion won (about 21.675 billion yuan), down 10.5% year-on-year; Operating profit was 152 billion won (about 819 million yuan), down 44.1% year-on-year. Among them, the sales in the fourth quarter of 2023 was 1,018 billion won (about 5.487 billion yuan), down 14% year-on-year; Operating profit was 29.9 billion won (about 161 million yuan), down 62% year-on-year.

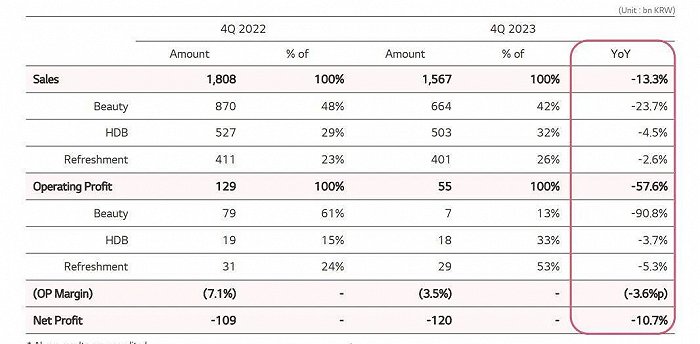

8. LG’s healthy life: weak demand in China has become the key to the decline in performance

On January 31st, LG Life Health released its fourth quarter and full-year financial report for 2023.

According to the financial report, the annual sales of LG Life Health in 2023 was 6804.8 billion won (about RMB 36.609 billion), down 5.3% year-on-year, and its operating profit was 487 billion won (about RMB 2.616 billion), down 31.5% simultaneously. In Q4 of 2023, LG’s life and health sales amounted to 1,567.2 billion won (about RMB 8.419 billion), down 13.3% year-on-year, and its operating profit was 54.7 billion won (about RMB 294 million), down 57.6% year-on-year.

LG Life Health said in the financial report that the sales of beauty cosmetics, HDB and refreshments all declined in 2023, the profitability of beauty cosmetics declined due to weak demand in China, and the operating profit declined due to overseas restructuring.

In the "Times Meeting Room" column, the reporter had an in-depth conversation with Sun Huaiqing, Chairman and CEO of the Board of Directors, and Xu Xiaofang, Chief Analyst of Beauty and Commerce of CITIC Securities Research Department, to analyze the reasons behind the rise of domestic beauty products, discuss how technology can reshape the competitive landscape of China’s beauty industry in the "Composition Age", and look forward to the investment opportunities of beauty track in 2024.

In the "Times Meeting Room" column, the reporter had an in-depth conversation with Sun Huaiqing, Chairman and CEO of the Board of Directors, and Xu Xiaofang, Chief Analyst of Beauty and Commerce of CITIC Securities Research Department, to analyze the reasons behind the rise of domestic beauty products, discuss how technology can reshape the competitive landscape of China’s beauty industry in the "Composition Age", and look forward to the investment opportunities of beauty track in 2024.