Ten years after its establishment, Flash plans to go public in the United States.

According to the official website of the US Securities and Exchange Commission (SEC), on September 13th, BingExLimited (stock code: "FLX") submitted a prospectus to be listed on NASDAQ, with China International Finance Corporation, CLSA, Deutsche Bank and UBS Investment Bank as underwriters.

Since its commercial operation in 2014, as of June 30, 2024, Flash Transport has about 2.7 million registered riders, and its service coverage has expanded to 295 cities in China.

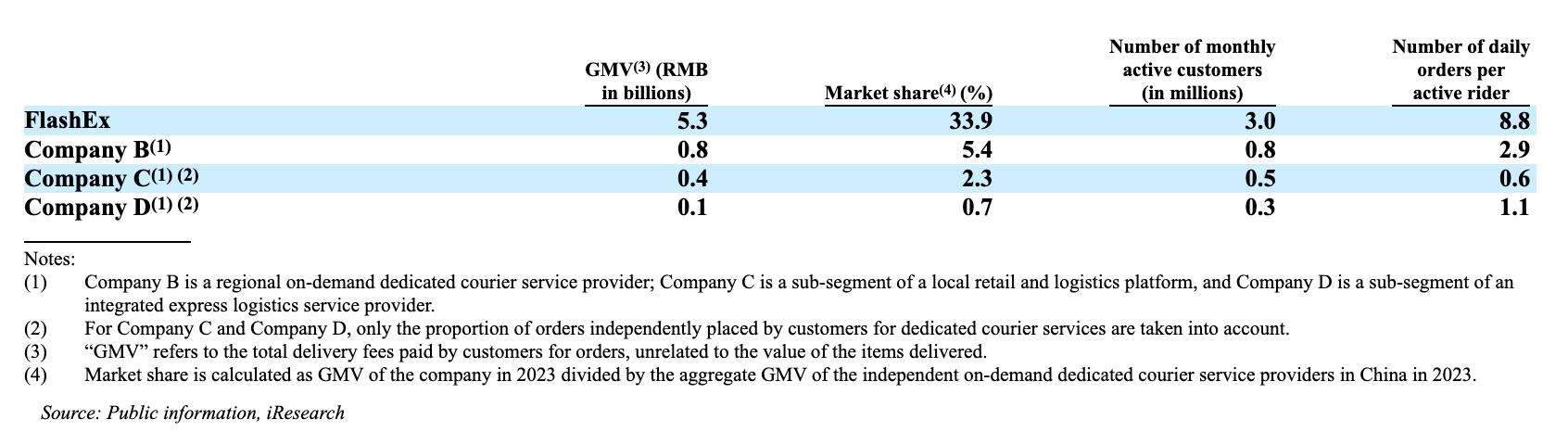

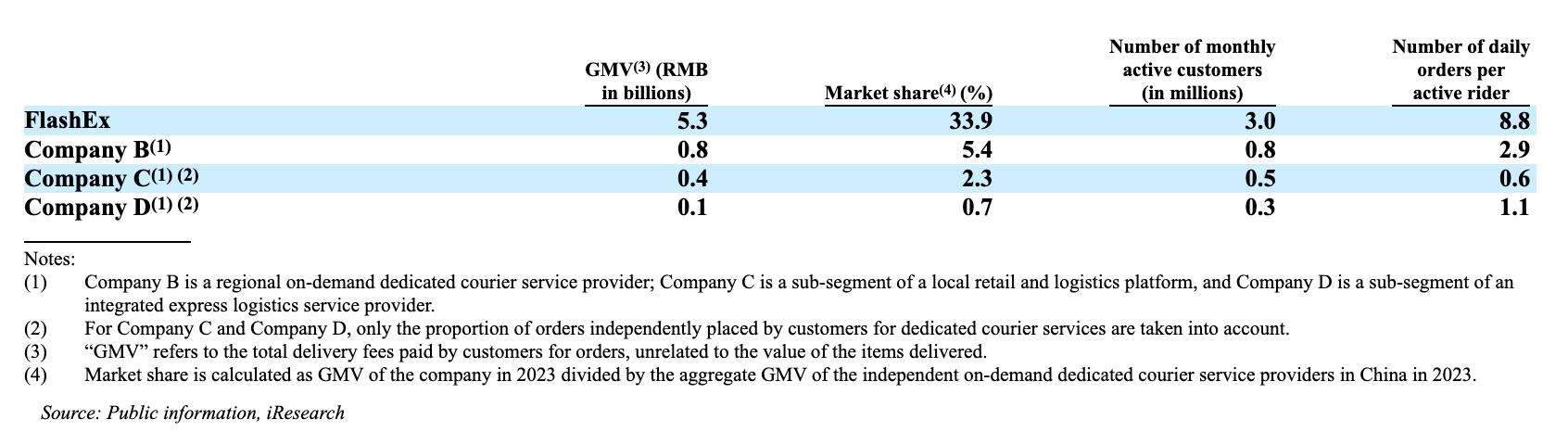

According to the data of the third party iResearch, according to the revenue in 2023, Flash Delivery is the largest independent express delivery service provider in China, with a market share of about 33.9%. According to the prospectus, unit economic benefit and replicable network are the core competitive advantages of Flash, which enables the company to continuously expand its scale and order volume and improve its profitability.

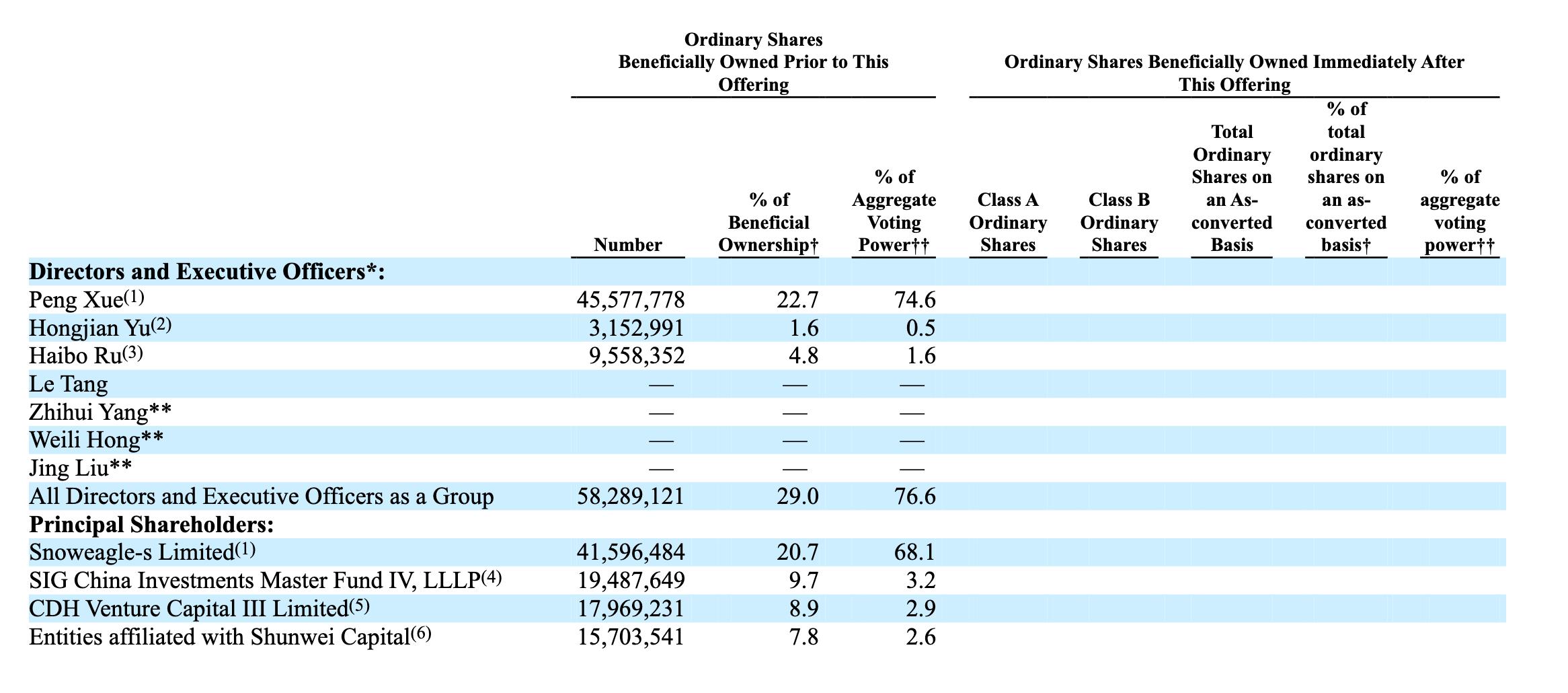

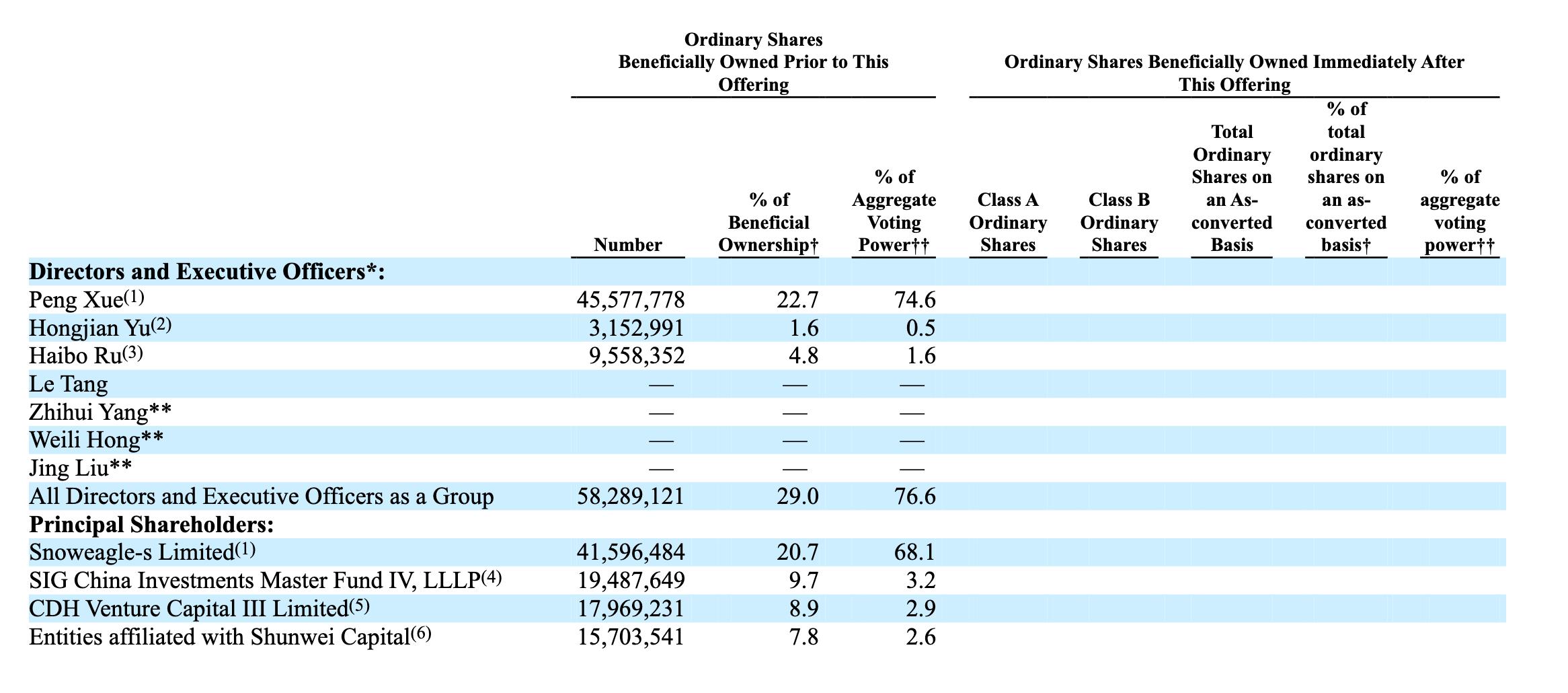

Xue Peng, the founder of Flash, is a veteran in the logistics industry. He has been the CEO since the establishment of the company and has been a director since May 2014. Before the establishment of Flash Delivery, China Express Logistics Integrated Service Platform Easy Post was established and developed. Yu Hongjian, co-founder, director and CEO of Flash, is Xue Peng’s old partner. He worked with Xue Peng for many years before he founded Flash.

According to the prospectus, before the IPO, Xue Peng held 22.7% equity and 74.6% voting rights; Yu Hongjian holds 1.6% equity and 0.5% voting rights. Among institutional shareholders, SIG, CDH Venture Capital and Shun Wei Capital hold 9.7%, 8.9% and 7.8% respectively. They have 3.2%, 2.9% and 2.6% voting rights respectively.

According to Tianyancha, Flash has gone through more than ten rounds of financing since its establishment ten years ago. The latest round of financing was completed in 2021. According to the prospectus, in March, April and May of 2021, Flash received 747.8 million yuan from the D-2 round of financing.

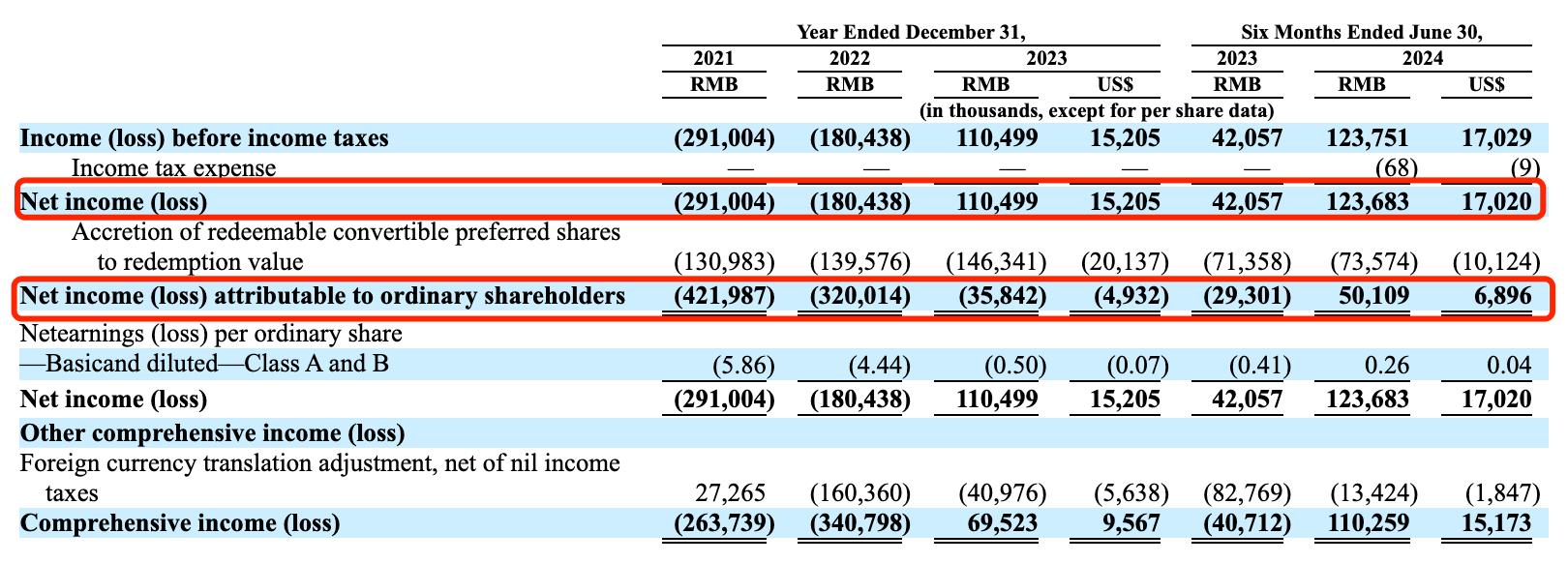

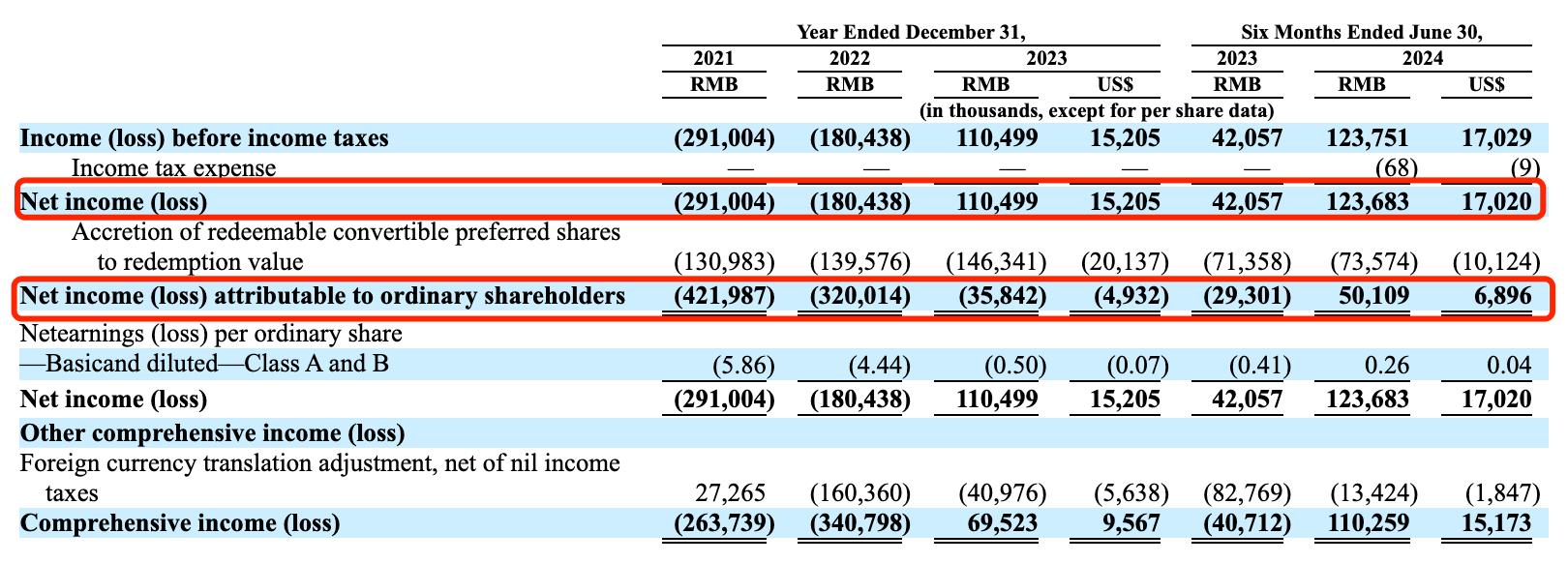

In 2023, it turned losses into profits, and the annual gross profit margin increased year by year, but it was less than 10%.

As a one-to-one express delivery platform in the instant delivery industry in the same city, Flash delivery is a pioneer in the instant delivery industry in the same city, providing various exclusive services for different types of delivery for customers, and the share of Flash delivery is the largest according to the revenue in 2023.

Compared with other real-time delivery platforms, flash delivery once said that its biggest feature is focusing on "one-to-one express delivery", which means that a flash operator is responsible for the whole service process from picking up items from the sender to delivering them to the recipient, and a flash operator can only take one order at a time, and will not take other orders until the current order ends. For this reason, many users tend to choose more respectful exclusive services when faced with the delivery needs of important items such as gifts.

According to the prospectus, it is estimated that from 2023 to 2028, the independent on-demand express delivery market in China will grow at a compound annual growth rate of 27.8%, exceeding the compound annual growth rate of 19.1% of the overall on-demand delivery market in China. By 2028, the overall on-demand distribution market in China will increase to 809.6 billion yuan, and the independent on-demand express delivery market in China will increase to 53.237 billion yuan.

However, at present, the competition in the instant delivery industry in the same city is fierce, and SF Express in the same city, Meituan Delivery in the takeaway department and Dada Group in the e-commerce department are all accelerating to seize the market.

Dada Group (Nasdaq: DADA) was listed on NASDAQ Exchange on June 5, 2020. SF City (9699.HK) was listed on the Hong Kong Stock Exchange in December 2021. Among them, the "first instant retail share" Dada Group has not yet achieved profitability. As the largest third-party instant delivery service in China, Shunfeng Tongcheng started to exert its strength. In 2023, its revenue reached 12.4 billion yuan, an increase of over 20%, and it achieved full-year profit for the first time. In the first half of this year, the income was nearly 6.88 billion yuan, a year-on-year increase of 19.6%; The net profit attributable to the owners of the company reached a record high of about 62.17 million yuan, up 105.1% year-on-year. It is worth noting that after landing in the capital market, the share price of Dada Group has fallen by over 90% compared with the issue price, and the share price of Shunfeng City has fallen by over 30%.

The prospectus shows that the flash has achieved profitability in 2023. The increase in customer demand has promoted higher order volume, and the growing number of riders has enhanced network density and delivery capacity, which has brought about organic growth in customer base and order volume.

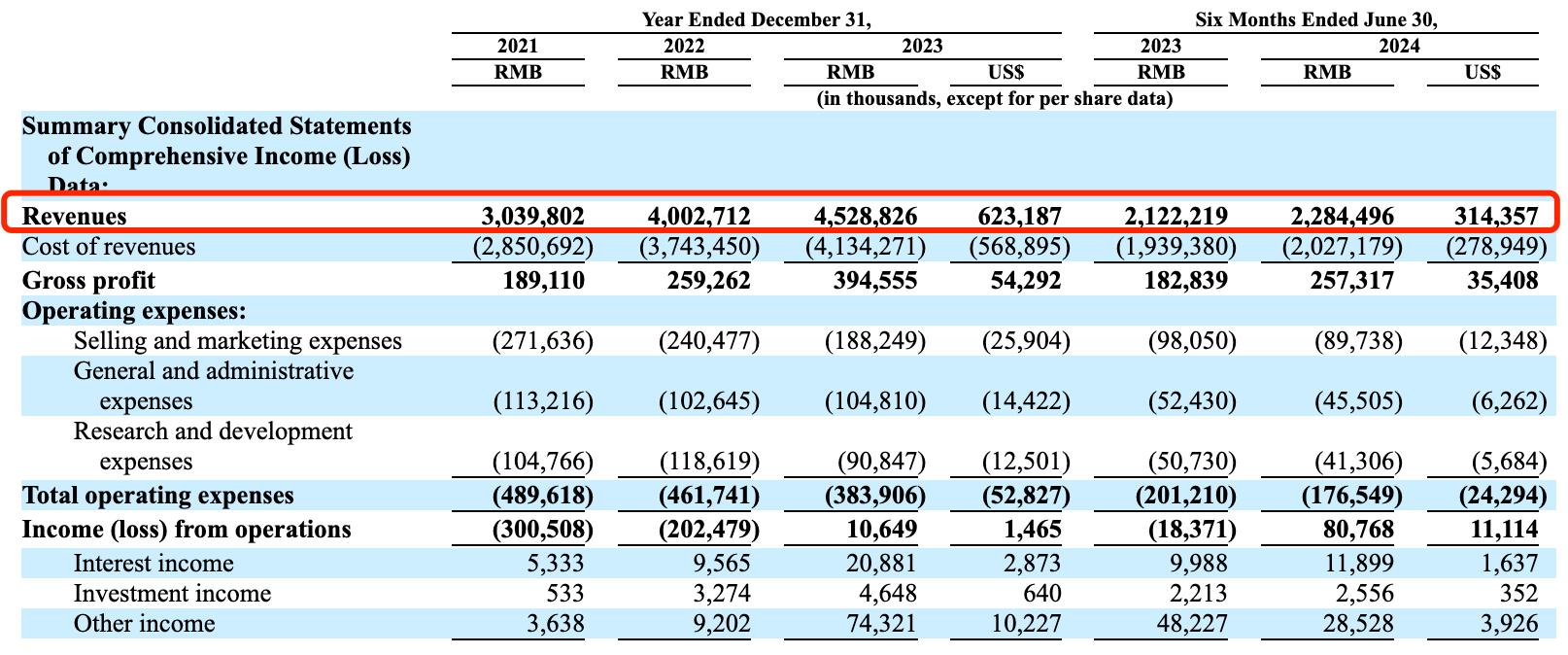

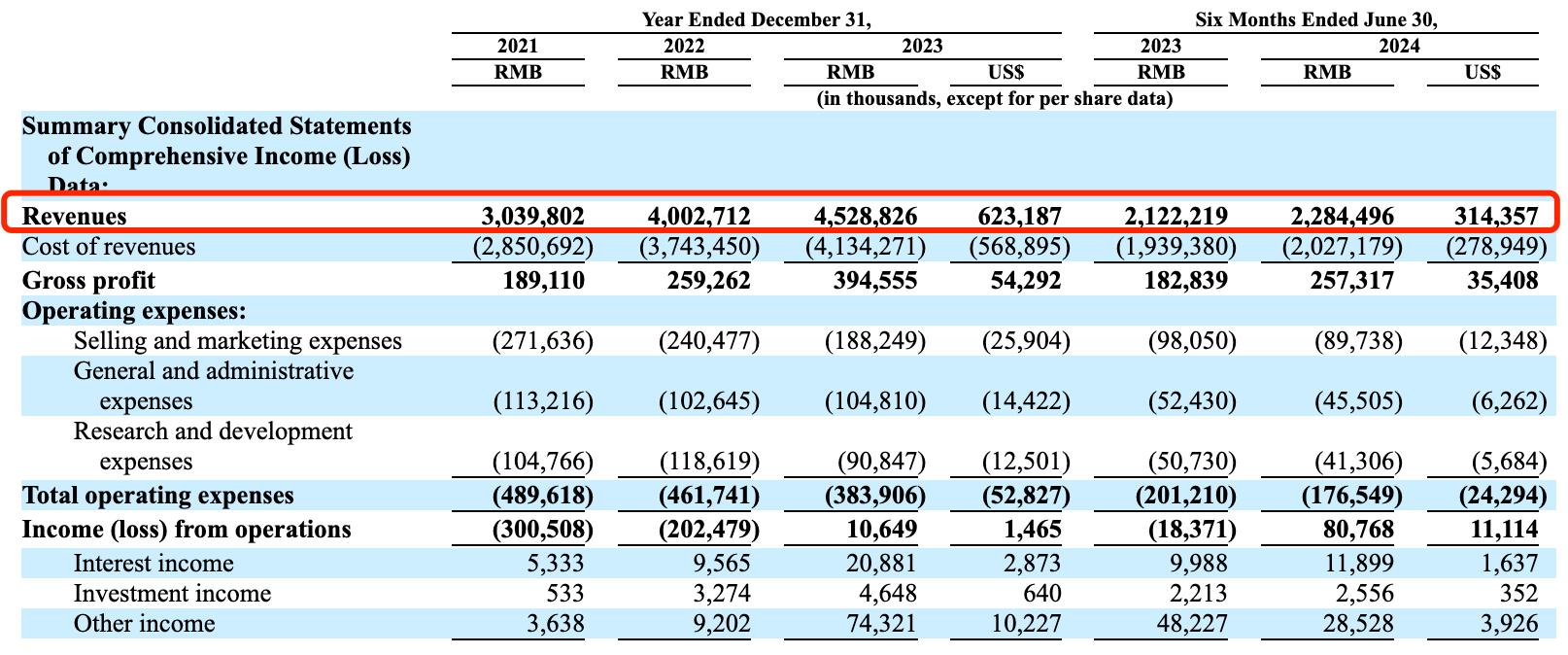

Specifically, in the past three years, the revenue of flash delivery was 3.04 billion yuan, 4.003 billion yuan and 4.529 billion yuan respectively, of which 2022 and 2023 increased by 31.6% and 13.1% respectively. In the first half of this year, the revenue from flash transmission was 2.285 billion yuan, a year-on-year increase of 7.6%.

In the past three years, the net profit was-291 million yuan,-180 million yuan and 110.5 million yuan respectively, of which the year-on-year loss was reduced by 38.1% in 2022, and it turned losses into profits in 2023. In the first half of this year, the net profit was 123.7 million yuan, a year-on-year increase of nearly two times. In 2023, the net profit rate was 2.4% and the net loss rate was 4.5%. The net profit rate in the first half of this year was 5.4%, compared with 2% in the same period last year.

The prospectus pointed out that the realization of profit in 2023 was mainly due to the increase in government subsidies determined by relevant government departments as appropriate.

In the past three years, the gross profit margin has increased year by year, 6.2%, 6.5% and 8.7% respectively. The gross profit margin in the first half of this year was 11.3%, compared with 8.6% in the same period last year.

The average charge for flash delivery is 16.5 yuan per order: the income is declining year by year, which is obviously higher than that of peers.

According to the prospectus, all the income from flash delivery comes from the fees charged for providing on-demand express delivery services to customers. Flash delivery provides a unified pricing model, and the floating rate of each order is calculated according to the formulas of city, delivery distance, package weight and volume, and night surcharge. If the supply is insufficient due to bad weather or other reasons, the "peak price" may be adopted.

According to reports, the flash network mainly recruits riders through crowdsourcing mode, most of them are crowdsourcing individuals, and a small number of them are recruited from outsourcing distribution agencies in a few cities. After back training, riders become flash riders. According to the prospectus, with high-value services and crowdsourcing mode, we can maintain the light asset business model, reduce fixed costs and maintain high scalability, and quickly enter more cities.

Specifically, the number of registered flash riders increased from about 1.1 million in early 2021 to about 2.7 million on June 30, 2024. The number of registered customers increased from about 31.1 million in early 2021 to about 88.9 million on June 30, 2024. In addition, the number of daily orders for each active rider increased from 7.2 orders in 2021 to 8 orders in 2022, and further increased to 8.8 orders in 2023 and 9.3 orders in the six months to June 30, 2024.

In the past three years, the number of flash orders was 158.6 million, 213.4 million and 270.7 million. In the first half of this year, 138.1 million orders were completed. The corresponding income is 3.04 billion yuan, 4.003 billion yuan, 4.529 billion yuan and 2.285 billion yuan respectively. Based on this calculation, the average income of a single order in the past three years and the first half of this year was 19.2 yuan, 18.8 yuan, 16.7 yuan and 16.5 yuan respectively, showing a downward trend year by year.

It is worth noting that the prospectus quoted the data of the third party iResearch, showing that within six months as of June 30, 2024, Flash delivery can charge a fee at an average price of 16.5 yuan per order, which is significantly higher than that charged by other major participants in the on-demand distribution industry.

However, in terms of risk factors, the prospectus mentioned that although Flash does not intend to compete with aggressive pricing policies that are not conducive to long-term growth, it cannot guarantee that it will not be forced to lower the delivery price of customers, increase the customer incentives we provide or increase our marketing and other expenses to attract and retain customers due to competition, supervision or other reasons, in order to cope with the competitive pressure.

In addition, the salary and reward paid to "Flash Ride" are the largest components of the income cost, accounting for 90.5%, 90.3% and 87.8% of the total income in the past three years, 85.4% in the first half of this year and 87.9% in the same period last year. According to the prospectus, this shows that even in the rapid expansion stage, flash delivery can maintain a stable cost structure in the same period.

As for the growth strategy, the prospectus points out that it plans to continue to expand market share, broaden service scope and application scenarios, strengthen market-leading brand image and invest in advanced and innovative technologies. According to the prospectus, the flash delivery plan improves the penetration rate of the existing market through differentiated distribution services. At present, flashover is still in the early stage of covering the target market, and the geographical coverage of flashover will be extended to more cities in China in the near future. In addition, it plans to use its highly scalable business to expand service products to cover more application scenarios.